CONQUEST

Risk-Focused Active Asset Allocation

CONQUEST is a suite of professionally managed asset allocation portfolios that seek to control risk and generate solid risk-adjusted returns above the rate of inflation. Continuously managed by the Washington Crossing Advisors team for over a decade, CONQUEST active asset allocation portfolios offer a seasoned, top-down, active alternative to traditional “buy-and-hold” asset allocation strategies.

Risk Management

Portfolios are available with different target asset mixes around which equity exposure can vary (±15%) based on Washington Crossing’s shorter-term market views. Further, portfolios allow for some deviation from long-run target allocations based on evolving market conditions. We seek to manage risk by combining long-run strategic and shorter-term active perspectives in one portfolio.

Two Ways

- Strategic Asset Allocation Choice

Sometimes called the “strategic” or “policy” allocation, this involves the overall, long-term mix of assets. You and your advisor can work together to find what overall strategic allocation best suits your needs.

Note: The special report, “Investing in Times of Uncertainty” may be helpful in talking to your advisor about the strategic asset allocation choice. - Ongoing Active Management

Because market prices and risk constantly change, active management can play a role in addressing risk and potentially exploiting opportunities.

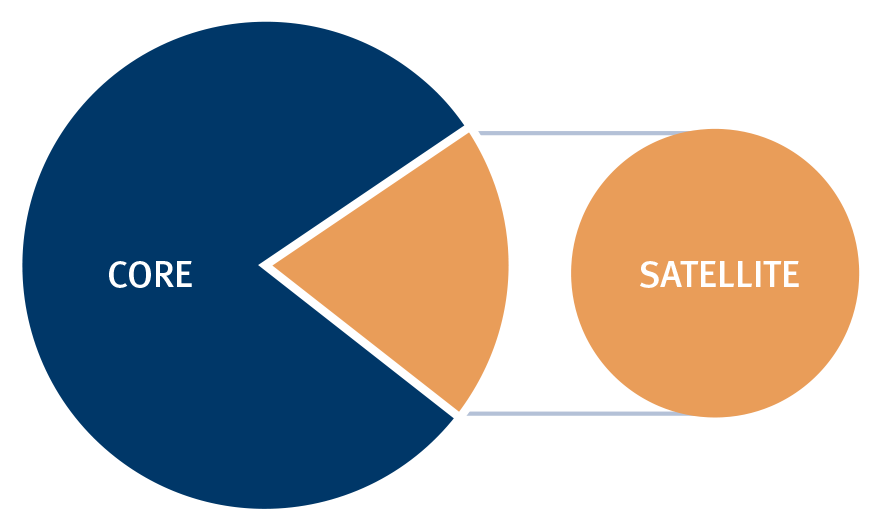

Portfolio Construction

We view each portfolio as having two parts (chart, below). The “satellite” takes a short-term perspective and focuses on month-by-month fundamental market and economic trends. The “core” of the portfolio evaluates prospects over a one-to-three year forecast horizon. A major advantage of combining short and longer perspectives in one portfolio is the potential to outperform a benchmark while carefully managing risk exposures to a long-run plan.

Core-Satellite

70% Core (1-3 Year Ahead Focus)

A diversified mix of assets focused on long-run expected risk and reward. Evolving risk and return expectations, based on valuation and relative price momentum, determines the weightings of assets relative to the benchmark’s risk exposures.

30% Satellite (3-6 Month Ahead Focus)

A regular evaluation of month-to-month fundamental trends determines the mix of stocks and bonds in the “satellite.” When the 3-6 month forecast of incoming data is expected to show improvement, the satellite will be more heavily concentrated in stocks over bonds. A deteriorating forecast shifts the mix toward bonds and away from stocks.

Target Asset Mixes

Portfolios are diversified among various asset classes through exchange-traded funds (ETFs). Each portfolio has a defined target mix of stocks, bonds, and alternative assets. Deviations from the target stock/bond mix can range from 0 to 15% based on Washington Crossing Advisors’ evolving active decisions.

Overview

Active Range: ±15% vs. Target

| Portfolio | Stocks | Bonds | Alts** |

|---|---|---|---|

| Moderately Aggressive Growth | 75% | 15% | 10% |

| Moderate Growth * | 63% | 27% | 10% |

| Balanced * | 45% | 45% | 10% |

| Conservative * | 27% | 63% | 10% |

| Fixed Income | — | 100% | — |

* Tax free municipal fixed income option available

** Includes high yield corporate bond, gold, real-estate asset classes

Moderately Aggressive Growth

75% Common Stocks | 15% Bonds | 10% Alts

Primarily invests in equity funds. Capital appreciation is the dominant driver of return, with income as a secondary consideration. This portfolio may be appropriate for investors with very long-term investment goals (15+ years) and a high risk tolerance.

Moderate Growth

63% Common Stocks | 27% Bonds | 10% Alts

Primarily invests in equity funds with a smaller allocation to fixed income. Capital appreciation is emphasized over current income. This portfolio may be appropriate for investors with long-term investment goals (10+ years) and higher risk tolerance.

Balanced

45% Common Stocks | 45% Bonds | 10% Alts

A mix of equity and fixed income investments. This portfolio may be appropriate for investors with a medium investment time horizon (7+ years) and a moderate risk tolerance.

Conservative

27% Common Stocks | 63% Bonds | 10% Alts

Mainly focused on the fixed income asset class, but also includes some exposure to equities. This portfolio may be appropriate for investors with goals that need to be met over a shorter investment time horizon (5+ years) and a lower risk tolerance.

Fixed Income

100% Bonds | 0% Bonds | 0% Alts

This portfolio invests entirely in the fixed income asset class. The portfolio may be appropriate for investors with goals that fall within a short investment time horizon (3+ years) and low risk tolerance. This portfolio might also be considered as an active fixed income “sleeve” alongside a stand-alone equity strategy.

Ongoing Management

Many asset allocation strategies only consider the long-run, often viewed as a decade or more. By contrast, CONQUEST active asset allocation (TAA) recognizes that shorter-term considerations are also important. CONQUEST involves making short-to-intermediate term adjustments to asset class weights based on shorter-term predictions of relative performance among asset classes.

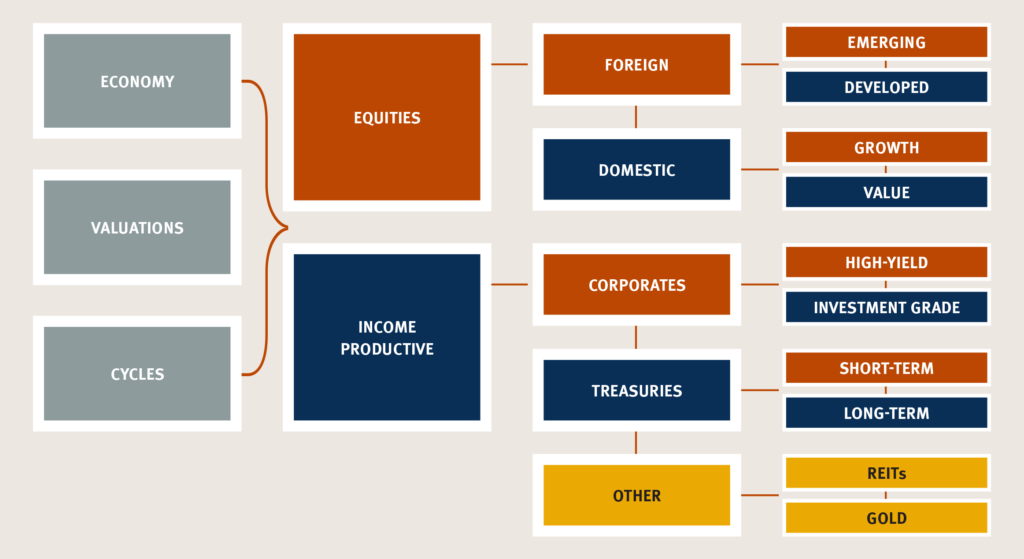

To add value over the short-term, we seek to exploit temporary deviations of asset-class values from their expected long-term relationships. Changes in the underlying risk and pricing of asset classes, and observations about the economy, credit cycle, and market fundamentals, can cause our short-term return expectations to differ from longer-term views. The decision tree below highlights important portfolio decisions that may require ongoing monitoring and management.

Decision Tree

Summary

CONQUEST is a seasoned program of active asset allocation using exchange-traded funds. A variety of target asset mixes, including stocks, bonds, and other assets, are available to fit different risk requirements and long-run expectations. Because short-term views can differ from longer-term expectations, CONQUEST seeks to add value by exploiting these differences through measured active adjustments on an ongoing and systematic basis.

We believe CONQUEST is appropriate for an investor who seeks a diversified portfolio for the long-run, and wishes to preserve some flexibility and seek higher returns through ongoing, professional active management.

Related Commentaries:

[{"id":36282,"link":"https:\/\/washingtoncrossingadvisors.com\/wca-annual-viewpoint-2026\/","name":"wca-annual-viewpoint-2026","thumbnail":{"url":false,"alt":false},"title":"WCA Annual Viewpoint 2026","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Jan 6, 2026","dateGMT":"2026-01-06 16:00:06","modifiedDate":"2026-01-06 16:01:58","modifiedDateGMT":"2026-01-06 16:01:58","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/economy\/\" rel=\"category tag\">Economy<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/economy\/\" rel=\"category tag\">Economy<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":56},"status":"publish","content":"PDF The past year was marked by sharp swings in market confidence. After a brief period of heightened volatility and tariff-related anxiety, optimism returned quickly, driven by enthusiasm around artificial"},{"id":36040,"link":"https:\/\/washingtoncrossingadvisors.com\/4q2025-quarterly-update\/","name":"4q2025-quarterly-update","thumbnail":{"url":false,"alt":false},"title":"4Q2025 Quarterly Update","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Oct 13, 2025","dateGMT":"2025-10-13 18:27:24","modifiedDate":"2026-01-05 19:27:59","modifiedDateGMT":"2026-01-05 19:27:59","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":31},"status":"publish","content":"PDF As 2025 draws to a close, the economy remains stronger than many expected. The Federal Reserve\u2019s modest 0.25% rate cut to 4.25% signals a gentler stance, but persistent inflation"},{"id":35940,"link":"https:\/\/washingtoncrossingadvisors.com\/quarterly-update-2025q3\/","name":"quarterly-update-2025q3","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2025Q3)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Jul 11, 2025","dateGMT":"2025-07-11 13:33:55","modifiedDate":"2025-07-11 13:34:54","modifiedDateGMT":"2025-07-11 13:34:54","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":29},"status":"publish","content":"PDF Markets have proven more resilient than expected in the first half of 2025, rebounding quickly from tariff-driven volatility. While headline earnings remain strong, pressures are building beneath the surface"},{"id":35805,"link":"https:\/\/washingtoncrossingadvisors.com\/wca-conquest-commentary-q2-2025\/","name":"wca-conquest-commentary-q2-2025","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2025Q2)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Apr 9, 2025","dateGMT":"2025-04-09 19:25:54","modifiedDate":"2025-10-02 13:31:18","modifiedDateGMT":"2025-10-02 13:31:18","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":37},"status":"publish","content":"PDF President Trump\u2019s April 2 tariff announcement marks a pivotal moment in global economic policy, reflecting a broader shift from globalization toward protectionism and nationalism. While globalization delivered real benefits\u2014lower"},{"id":35622,"link":"https:\/\/washingtoncrossingadvisors.com\/viewpoint-2025\/","name":"viewpoint-2025","thumbnail":{"url":false,"alt":false},"title":"Annual Viewpoint (2025Q1)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Dec 20, 2024","dateGMT":"2024-12-20 16:52:40","modifiedDate":"2025-06-20 19:26:50","modifiedDateGMT":"2025-06-20 19:26:50","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":48},"status":"publish","content":"The U.S. economy in 2024 showed remarkable resilience against inflation, rising interest rates, and global uncertainties. GDP expanded, consumer confidence stayed strong, and household wealth hit $155 trillion. This reflects"},{"id":35584,"link":"https:\/\/washingtoncrossingadvisors.com\/wca-quarterly-commentary-q4-2024\/","name":"wca-quarterly-commentary-q4-2024","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2024Q4)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Oct 15, 2024","dateGMT":"2024-10-15 20:21:14","modifiedDate":"2025-06-20 19:27:25","modifiedDateGMT":"2025-06-20 19:27:25","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":31},"status":"publish","content":"U.S. stock market valuations have reached a historic $60 trillion, with GDP and household net worth doubling since 2009. Employment has grown by 30 million jobs, and S&P 500 profit"},{"id":35482,"link":"https:\/\/washingtoncrossingadvisors.com\/wca-quarterly-commentary-3q24\/","name":"wca-quarterly-commentary-3q24","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2024Q3)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Jul 10, 2024","dateGMT":"2024-07-10 14:35:11","modifiedDate":"2025-06-20 19:28:14","modifiedDateGMT":"2025-06-20 19:28:14","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":32},"status":"publish","content":"The U.S. economy grew to a record $28 trillion annualized in Q1, the equity market added $9 trillion over the past year, reaching a record $57 trillion, and our WCA"},{"id":35138,"link":"https:\/\/washingtoncrossingadvisors.com\/viewpoint-2024\/","name":"viewpoint-2024","thumbnail":{"url":false,"alt":false},"title":"Annual Viewpoint (2024Q1)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Dec 21, 2023","dateGMT":"2023-12-21 21:55:46","modifiedDate":"2025-06-20 19:28:22","modifiedDateGMT":"2025-06-20 19:28:22","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/washingtoncrossingadvisors.com\/tag\/asset-allocation\/' rel='post_tag'>asset allocation<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/barometer-update\/' rel='post_tag'>barometer update<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/kevin-caron-cfa\/' rel='post_tag'>Kevin Caron CFA<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/long-run-return-expectation\/' rel='post_tag'>Long-run return expectation<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/u-s-equity-market\/' rel='post_tag'>U.S. equity market<\/a>"},"readTime":{"min":0,"sec":43},"status":"publish","content":"Over the past year, the economy and financial markets have surpassed most forecasters\u2019 expectations. The U.S. economy grew at an annualized rate of 5% in the third quarter of 2023,"},{"id":35059,"link":"https:\/\/washingtoncrossingadvisors.com\/q4-2023-conquest-tactical-asset-allocation\/","name":"q4-2023-conquest-tactical-asset-allocation","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2023Q4)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Oct 16, 2023","dateGMT":"2023-10-16 15:05:49","modifiedDate":"2025-06-20 19:28:43","modifiedDateGMT":"2025-06-20 19:28:43","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/tactical-shift\/\" rel=\"category tag\">Tactical Shift<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/tactical-shift\/\" rel=\"category tag\">Tactical Shift<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":30},"status":"publish","content":"Full Report Although the economy is faring better than expected this year, we see a mixed bag of signals. Forexample, while popular market-capitalization weighted stock indices are up for the"},{"id":34908,"link":"https:\/\/washingtoncrossingadvisors.com\/q3-2023-conquest-tactical-asset-allocation\/","name":"q3-2023-conquest-tactical-asset-allocation","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2023Q3)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Jul 14, 2023","dateGMT":"2023-07-14 18:07:31","modifiedDate":"2025-06-20 19:29:04","modifiedDateGMT":"2025-06-20 19:29:04","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/tactical-shift\/\" rel=\"category tag\">Tactical Shift<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/tactical-shift\/\" rel=\"category tag\">Tactical Shift<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":27},"status":"publish","content":"Full Report As we pointed out in our Viewpoint 2023, the air of gloom that hung over markets at the start of the year was extreme. Instead, we saw improving"},{"id":34743,"link":"https:\/\/washingtoncrossingadvisors.com\/q2-2023-conquest-tactical-asset-allocation\/","name":"q2-2023-conquest-tactical-asset-allocation","thumbnail":{"url":false,"alt":false},"title":"Quarterly Update (2023Q2)","postMeta":[],"author":{"name":"Jeffrey Battipaglia","link":"https:\/\/washingtoncrossingadvisors.com\/author\/battipagliaj\/"},"date":"Apr 17, 2023","dateGMT":"2023-04-17 14:32:31","modifiedDate":"2025-06-20 19:29:16","modifiedDateGMT":"2025-06-20 19:29:16","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/tactical-shift\/\" rel=\"category tag\">Tactical Shift<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/tactical-shift\/\" rel=\"category tag\">Tactical Shift<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":0,"sec":24},"status":"publish","content":"Full Report Surging inflation and interest rate expectations undermined stock and bond markets last year. There are nascent signs these trends may be reversing. Accordingly, stocks and bonds have rallied"},{"id":34476,"link":"https:\/\/washingtoncrossingadvisors.com\/viewpoint-2023\/","name":"viewpoint-2023","thumbnail":{"url":false,"alt":false},"title":"Annual Viewpoint (2023Q1)","postMeta":[],"author":{"name":"kcaron","link":"https:\/\/washingtoncrossingadvisors.com\/author\/kcaron\/"},"date":"Jan 18, 2023","dateGMT":"2023-01-18 19:26:57","modifiedDate":"2025-06-20 19:29:35","modifiedDateGMT":"2025-06-20 19:29:35","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a>, <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>","space":"<a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/conquest\/\" rel=\"category tag\">Conquest<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/long-run-views\/\" rel=\"category tag\">Long Run Views<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/quarterly-outlook\/\" rel=\"category tag\">Quarterly Outlook<\/a> <a href=\"https:\/\/washingtoncrossingadvisors.com\/category\/weekly\/\" rel=\"category tag\">Weekly (distribution list)<\/a>"},"taxonomies":{"post_tag":"<a href='https:\/\/washingtoncrossingadvisors.com\/tag\/asset-allocation\/' rel='post_tag'>asset allocation<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/barometer-update\/' rel='post_tag'>barometer update<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/kevin-caron-cfa\/' rel='post_tag'>Kevin Caron CFA<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/long-run-return-expectation\/' rel='post_tag'>Long-run return expectation<\/a><a href='https:\/\/washingtoncrossingadvisors.com\/tag\/u-s-equity-market\/' rel='post_tag'>U.S. equity market<\/a>"},"readTime":{"min":0,"sec":29},"status":"publish","content":"We start 2023 coming off a tough 2022 for both stock and bond investors, where both assets suffered significant declines. However, inflation issues and higher interest rates, which dominated market"}]