Weekly Comment

The Doha oil talks concluded with a resounding thud over the weekend, as media sources reported an abrupt end to talks aimed at curtailing oil supply. Iran’s absence at the meeting was cited as a primary catalyst for the end of talks. We expect oil to trade lower, as markets unwind some of oil’s recent run-up that occurred in anticipation of more positive news. Brent crude closed Friday 14% above its 100-day moving average and more than 50% above the January lows near $26. Given the elevated correlation between credit spreads and oil prices, we would not be surprised to see some near-term spillover into financial markets more broadly, as oil market expectations are reset.

Growth Forecasts Cut

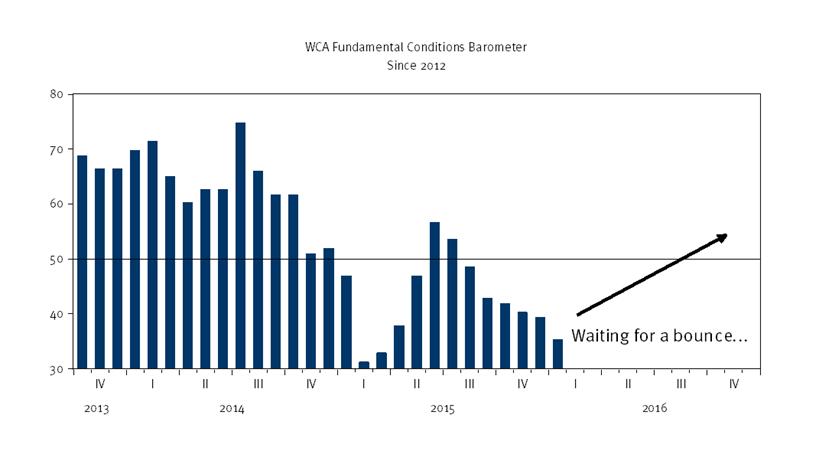

Meanwhile, we continue to focus on the overall health of conditions through the lens of our fundamental conditions barometer (graph, below). The barometer focuses separately on market based indicators, forward-looking domestic economic data, and foreign inputs. Collectively, they provide the impulses that drive our assessment of “fundamental” conditions. The weaker growth story pointed to by the barometer is now corroborated by the International Monetary Fund (IMF), who lowered estimates of world growth in their most recent World Economic Outlook. The IMF recently lowered its growth forecast to 3.2% from 3.4% in 2016, in part due to weak exports, slowing investment in the United States, slumping global commodity prices, and a consumption tax hike in Japan. Closer to home, the Atlanta Fed’s GDP Now model is tracking toward 0.3% real GDP growth for the first quarter.

Meandering Sideways: Equity Indices, Earnings, and Market Breadth

In our view, the recent rally in stocks was underwritten by a pivot by central banks toward a less hawkish posture in the case of the Federal Reserve (Fed) and greater easing by the European Central bank (ECB). However, the key ingredient of stronger real economic and earnings growth is not yet evident. We see that S&P 500 expected earnings still meander sideways, helped along by massive stock buybacks and hampered by slumping energy sector earnings. According to FactSet Research, the combination of lower cash flow and continued strong buybacks lifted the ratio of share buybacks to free cash flow to 102% last year. Meanwhile, investment as a percent of GDP fell in each of the last three quarters, and exports fell as a percent of GDP in each of the last six quarters. Consequently, the sideways movement in the S&P 500 and Dow are largely explained by the same behavior in the earnings per share figures in recent months. The more interesting stories are playing out in the bond market.

A closer look at the bond market reveals a tightening in real short-term interest rates starting in 2012 and followed by a rise in corporate credit spreads (Moody’s Baa – LT Treasury) from roughly 150 basis points in 2014 to over 220 basis points today, indicating concern over potential defaults tied to energy investments. The rise in credit spreads was accompanied by a steady climb in financial system stress as indicated by the St. Louis Fed’s Index of Financial System Stress and renewed underperformance by the S&P 500 financials index. Adding additional color to the story playing out in credit markets is background concern over the possibility of deflation. The long-run inflation expectations priced into the TIPS market have generally been sliding lower since 2014 as well.

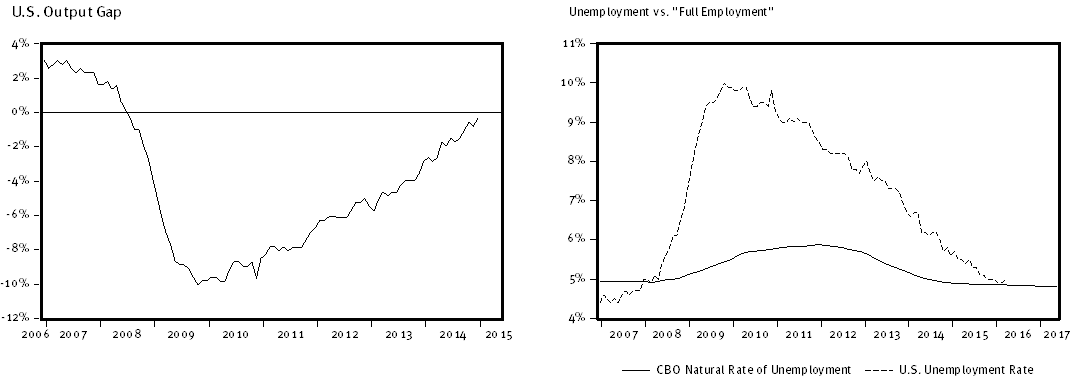

Complicating matters for the Fed is the fact that the employment picture continues to strengthen with the unemployment rate converging with “full employment” (Congressional Budget Office (CBO) estimate) and the output gap moving quickly toward 0% (see graphs, below). Based only on the output gap and employment data, the Fed should be tightening more aggressively, but the broader markets are not cooperating. Hence, the Fed is confronted with a dilemma — wait to raise and risk stoking bubbles or press rates higher and risk creating the very volatility they are seeking to avoid?

Something’s Got to Give

Will the economy kick back into gear through the second half or not? If so, we would expect to see data begin to turn. As of this writing, we cannot say that the market’s bounce off the bottom is supported by much in the way of broadly improving fundamentals. Neither market-based indicators or foreign data have turned sufficiently positive to warrant a change in tactical positioning since the start of the year, and the domestic economy portion of the data is at a near-neutral reading. We are prepared to move in either direction from here based upon the path for fundamentals.

Tactical Portfolio Posture

Portfolios remain modestly underweight equities / liquid alternatives and overweight fixed income in asset allocation portfolios. Portfolios are overweight domestic versus foreign and growth versus value. Portfolios remain underweight small cap equities. In fixed income, portfolios are overweight longer-duration investment grade corporates and underweight intermediate term government / credit.

Addendum: Earnings Season Underway

Earnings season is underway with an expected 9.3% Q1 decline in S&P 500 EPS expected including energy (-4.2% excluding energy), according to FactSet. The S&P 500 trades at 16.2 times forward expected earnings of $125 — 18% above the 10-year average of 14.2 times. On an enterprise value basis (includes debt), the S&P 500 trades at a 2.2x multiple of sales versus a 2.0x average multiple over the past 10 years (a 10% premium).

ECONOMIC RELEASES THIS WEEK

| Date | Report | Period | Survey | Prior |

| Monday, April 18: | NAHB Housing Market Index | April | 59 | 58 |

| Tuesday, April 19: | Housing Starts M/M | March | -1.1% | 5.2% |

| Building Permits M/M | March | 2.0% | -3.1% | |

| Wednesday, April 20: | Existing Home Sales M/M | March | 3.4% | -7.1% |

| Thursday, April 21: | Weekly Jobless Claims | April 16 | — | 253 K |

| Philadelphia Fed Business Outlook | April | 7.0 | 12.4 | |

| Friday, April 22: | PMI Manufacturing Index Flash | April | — | 51.5 |

ASSET ALLOCATION PORTFOLIO POSTURE

LONG-RUN STRATEGIC POSTURE: Our macro outlook is for slow growth and stubbornly low inflation. The start of policy normalization following years of zero interest rate policy in the United States comes at a time of weakening global growth and mixed signals from the domestic economy. We continue to view the United States economy as best positioned to weather the overall weak global environment that resurfaced in 2015.

Disclaimer

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecasted in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small company stocks are typically more volatile and carry additional risks, since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher quality bonds. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

The WCA Fundamental Conditions Barometer measures the breadth of changes to a wide variety of fundamental data. The barometer measures the proportion of indicators under review that are moving up or down together. A barometer reading above 50 generally indicates a more bullish environment for the economy and equities, and a lower reading implies the opposite. Quantifying changes this way helps us incorporate new facts into our near-term outlook in an objective and unbiased way. More information on the barometer is found in our latest quarterly report, available at www.washingtoncrossingadvisors.com/insights.html