Tractor Supply Company (NASDAQ: TSCO) Q1 ’23

8 February 2023 I Brentwood, TN

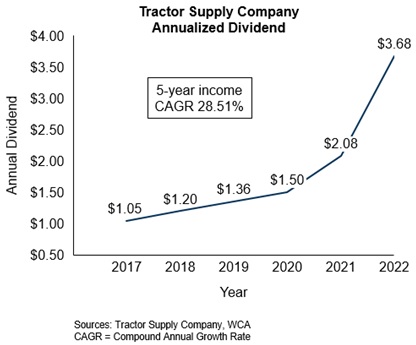

The board of directors of Tractor Supply Company (NASDAQ: TSCO) has declared a regular quarterly dividend of $1.03 per common share, an increase of approximately 12% from the previous quarterly dividend of $0.92.

For calendar year 2023, this marks the seventh dividend change for the Washington Crossing Advisors Rising Dividend portfolio. All seven changes were increases. The average dividend increase is 5.3% compared with December 31, 2022 indicated levels.

For a complete list of all portfolio holdings that have, in the past 12 months, increased, decreased, or had no change in dividend, please contact your financial advisor.

From the press release: “Tractor Supply Company (NASDAQ: TSCO), the largest rural lifestyle retailer in the United States, today announced that its Board of Directors declared a quarterly cash dividend of $1.03 per share of the Company’s common stock. This represents an increase of 12 percent versus the prior quarterly dividend rate of $0.92 per share.

“Today’s announcement marks the 14th consecutive year of increasing dividend payouts by Tractor Supply. This increase demonstrates the Board’s confidence in our Life Out Here strategy and strong cash flow generation, as we continue to invest for future growth while returning capital to shareholders,” said Cynthia Jamison, Tractor Supply’s Chairman of the Board.

The dividend will be paid on March 14, 2023 to stockholders of record of the Company’s common stock as of the close of business on February 27, 2023.”1

About the company: “Tractor Supply Company (NASDAQ: TSCO), the largest rural lifestyle retailer in the United States, has been passionate about serving its unique niche, targeting the needs of recreational farmers, ranchers and all those who enjoy living the rural lifestyle, for 85 years. Tractor Supply offers an extensive mix of products necessary to care for home, land, pets and animals with a focus on product localization, exclusive brands and legendary customer service for the Out Here lifestyle. With more than 50,000 Team Members, the Company’s physical store assets, combined with its digital capabilities, offer customers the convenience of purchasing products they need anytime, anywhere and any way they choose at the everyday low prices they deserve. As of December 31, 2022, the Company operated 2,066 Tractor Supply stores in 49 states, a consumer mobile app and an e-commerce website at www.TractorSupply.com. In October 2022, Tractor Supply acquired 81 stores from Orscheln Farm and Home that will be rebranded to Tractor Supply by the end of 2023.

Tractor Supply Company also owns and operates Petsense by Tractor Supply, a small-box pet specialty supply retailer focused on meeting the needs of pet owners, primarily in small and mid-size communities, and offering a variety of pet products and services. As of December 31, 2022, the Company operated 186 Petsense by Tractor Supply stores in 23 states. For more information on Petsense by Tractor Supply, visit www.Petsense.com.”1

IMPORTANT DISCLOSURES: The securities discussed herein do not represent all of the securities held by the WCA Rising Dividend Portfolio as of the date presented and are subject to change at any time, without notice. A complete list of holdings as of the date noted above will be provided upon request. The above is presented to illustrate the application of the strategy only and not intended as personalized recommendations of any particular security. The securities identified and described above do not represent all of the securities purchased, sold, or recommended for client accounts. You should not assume that an investment in any of the securities identified was or will be profitable. Changes in market conditions or a company’s financial condition may impact the company’s ability to continue to pay dividends. Companies may also choose to discontinue dividend payments. All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.