The “Profit” / “Quality” Connection

Imagine you have two options for investing your savings: keeping it in a piggy bank at home or investing in a local business. If the business can use your money to earn more than what it would cost you to lend it out (think of this as the interest you’d want if you just kept your money), it’s a sign that investing in the business might be worth considering.

The key is the business must not just earn a profit but a sufficient profit to compensate for the cost of the capital invested in the business, both debt (borrowed money) and equity (owner’s money). We refer to profit above and beyond the cost of capital as “economic profit.” Today, especially with higher interest rates, many companies are not earning their cost of capital and generating an “economic profit.”

Here are the main reasons why we focus heavily on profitability in this way:

• Value Creation: When a company earns more from its investments than what it costs to finance them, it’s effectively using creditor and investor money to generate more money. It’s not magic, but businesses who can do this are evidencing smart business decisions that grow value.

• Efficient Use of Resources: A company that can consistently turn a profit higher than its costs is doing something right. Whether it’s innovative products, efficient operations, or strong customer relationships, it means they’re using their resources wisely.

• Competitive Edge: Maintaining higher returns that cover costs while adequately compensating providers of capital can hint at a competitive advantage. They may have a better product, a stronger brand, or more efficient operations. Whatever it is, it sets them apart from the competition.

• Growth and Stability: We find companies that manage their investments well are generally more stable and have better prospects for growth. They might fund new projects from their earnings, reducing the need for external borrowing and possibly increasing their value over time.

When a company’s returns on capital outpace its cost, it’s a sign of good health and intelligent management. It doesn’t guarantee success, but it’s a positive indicator that the company is on the right track, making it an attractive option for inclusion in a portfolio.

A Look at Today’s Companies

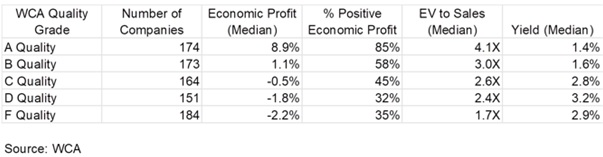

We decided to look at nearly 1,000 of the largest U.S. companies. Based on Bloomberg data, about half of companies are not earning sufficiently high return on capital to cover their cost of capital. Not surprisingly, the problem is more acute among the lower-graded companies in our study, based on our own “WCA Quality Grade.” That grade considers quantitative factors ranging from profitability, profit consistency, and debt level.

The table below breaks these companies down by “WCA Grade” from “A” to “F” and summarizes key facts. Not surprisingly, the “A” quality companies ranked highest on “economic profit,” and the “F” stocks the lowest. The further we go down the scale, the less likely we find companies earning their cost of capital, and the more likely we find companies failing to earn their cost of capital (based on the most recent data). The tradeoff for buying cheap and high-yielding stocks often comes at the expense of profitability. In our view, this tradeoff can be a costly and sometimes risky one that may not pay off in the long run. Instead, we find a focus on reasonably-priced stocks with steady dividend increases is a better way to go.

Quality and Profitability: Large U.S. Companies by WCA “Quality Grade”

Conclusion

While it might be tempting to do so, we find that starting the portfolio-building process with a focus on yield or “cheapness” puts the “cart before the horse.” And doing so only increases the chances the portfolio will be weakened by overexposure to potentially inefficient and less competitive businesses that may struggle to grow over time and may be more prone to weakness during tough times. Ultimately, ensuring strong profitability in quality companies is vital to value creation, which is why we will continue to focus sharply on profitability in assessing quality and value.