The Necessity of a Strong Consumer

Consistency is a big part of quality. Our search for consistency leads us to companies that generate dependable growth. And the most consistent growth engine of the world’s economy — decade after decade — has been the consumer. Household consumption sits at the center of our economy, accounting for over 70% of all activity in the United States. When threatened, government intervention has been there to help shore up consumption, come what may, and from administration to administration.

The reason for such policies are simple: employers all across the economy ultimately hire, invest, and produce to serve consumers. If consumption fails, employees are laid off, investment is cut, production falters, and businesses fail. Our history shows that the first priority is maintaining a steady “circular flow” of money throughout the economy by ensuring constant demand for goods and services — the main engine of which is the household consumer.

Long History of Steady, Dependable Growth

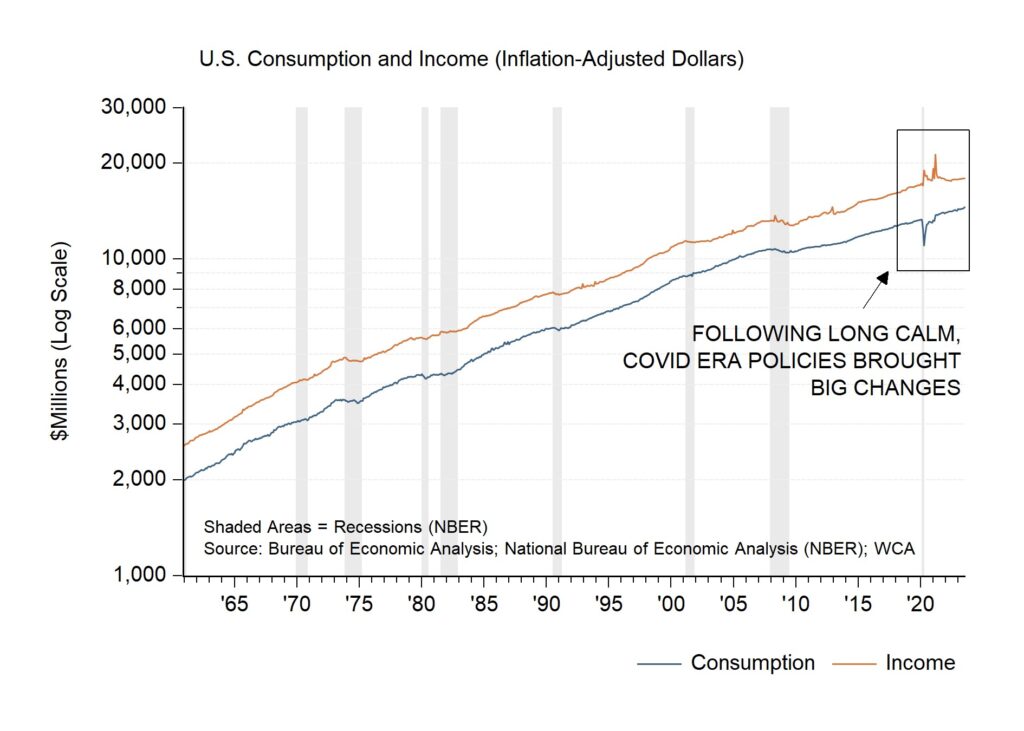

Consider Chart A below. Notice how consistent and steady growth in consumption has been throughout the years. It is hard to deny that there is strong evidence that, over time, consumption tends to grow along with personal income. Notice further that the graph shows income and consumption adjusted for inflation. From the early 1960s through today, there has been a solid and steady upward bias to these lines. Of course, the pandemic brought significant changes — more on that in a moment.

Chart A

While there is clear and unequivocal evidence of growth decade to decade, there have been a few times when consumption and income faltered before resuming an upward climb. 1974, for example, real income and consumption declined by -2.5% and -2.2%, respectively. In 1980, real income stagnated (0% growth), causing consumption to drop by 1.5% that year. In 1991, real income and consumption both fell by about 1%. Finally, in the financial crisis of 2008-2009, real income fell by a whopping -5%, and consumption fell by -2.5%.

Over the past year through July, consumption is up 3.1% after 3.3% inflation according to newly released data from the Bureau of Economic Analysis (BEA). This growth rate is faster than the 2.4% trend growth rate since 2012. We expect consumption to return to the lower trend-line growth rate in the years ahead. If this happens as expected, real consumption growth will slow to about 1% for the next few years.

The Pandemic Era

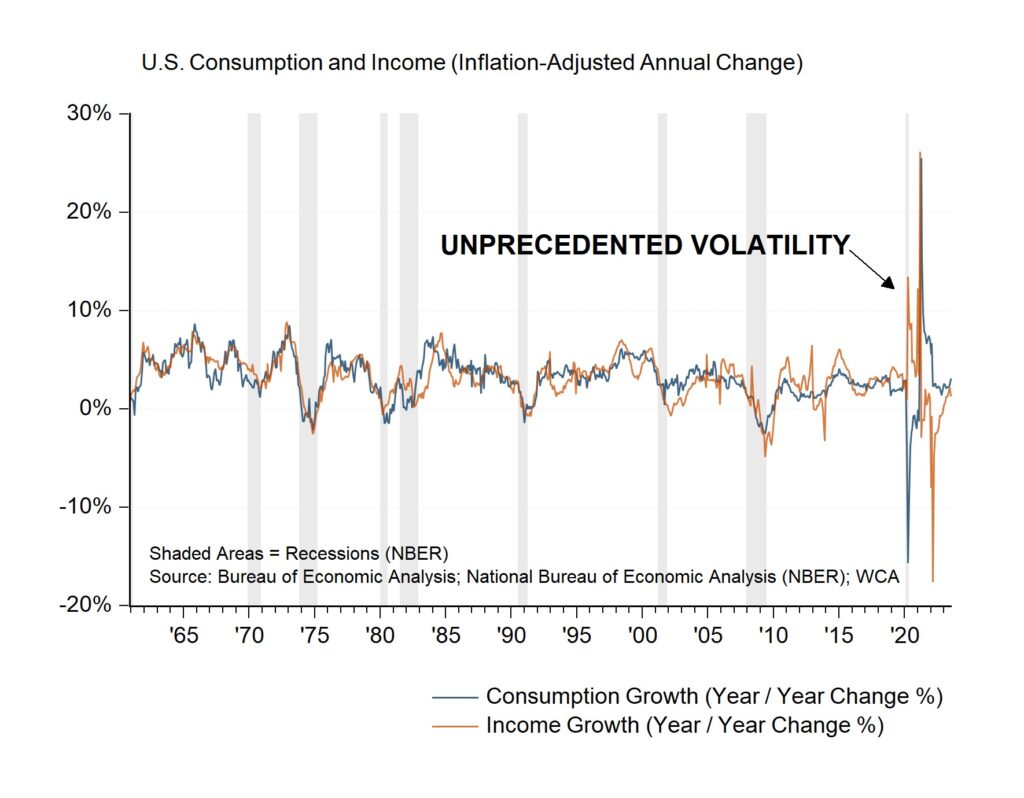

The above scenario overlooks one glaring issue — the immense impact of the pandemic and government responses following 2020. As Chart B (below) shows, the annual change in both income and consumption around the pandemic produced unprecedented volatility. Incomes, which include government payments to households and consumption, went on a wild ride. Today, many pandemic-era subsidies and supports are either gone or going away. Hence, some businesses that benefitted from government stimulus-aided sales to consumers are seeing softness in business.

Chart B

On the plus side, however, wages are growing, while the unemployment rate of 3.6% is near a 50-year low. For example, payroll processor Automatic Data Processing (ADP) reports that job changers are seeing an average 9.5% wage increase. Hourly wages are also up 4.4% year-over-year through July, according to the Bureau of Labor Statistics (BLS).

Conclusion

Although recent years brought big swings in income and growth, the consumer has proven to be a consistent and dependable source of growth for many decades. That said, we understand that the level of consumer spending that accompanied unprecedented stimulus in 2021-2022 is set to fade. Now we see consumption returning to trend. We expect this process to continue over the next two to three years. We believe world-class, financially solid, consumer-focused franchises should be held for the long-haul. We will continue to look for opportunities in quality businesses of all kinds as the process of “returning to normal” unfolds.