The Inflation Challenge

This week, the Federal Reserve meets to decide on interest rates. Most expect no change in rates, but inflation worries are leading to calls for the Fed to ease off the monetary throttle. The debate centers on whether recent inflation signs are permanent or transitory. The causes of today’s inflation may be linked to bottlenecks, federal spending, or a sharp rise in the money supply. Whatever the reason, the debate is likely to shape policy and market returns.

Evidence of Inflation’s Return

Inflation is the change in purchasing power of money, reflected in prices. The consumer price index (CPI) basket of goods is representative of changes in prices. Excluding food and energy, the CPI is up 5.4% through June, the fastest rise in over a decade. Producers are also seeing price increases, which raise the cost of doing business. Core producer prices, also excluding energy costs, are up 3.6%, also the fastest rise in a decade.

Commodity prices are also up. From depressed levels a year ago, the CRB commodity index is up 52%. The same index is up 18% from pre-pandemic levels. Crude oil prices are up to $72 per barrel, versus the mid-$30 range last fall and $60 pre-pandemic. And while gold is up about 15% since before the pandemic, cryptocurrencies have been on a tear.

For now, most believe the price rises are tied to reopening the economy and bottlenecks in global supply chains caused by COVID. This explains why today’s 5.4% rise in core consumer prices is not expected to continue. A look at the Treasury Inflation-Protected Bond market shows us bond investors are only pricing in 2.35% inflation over ten years.

Causes Beyond COVID-19

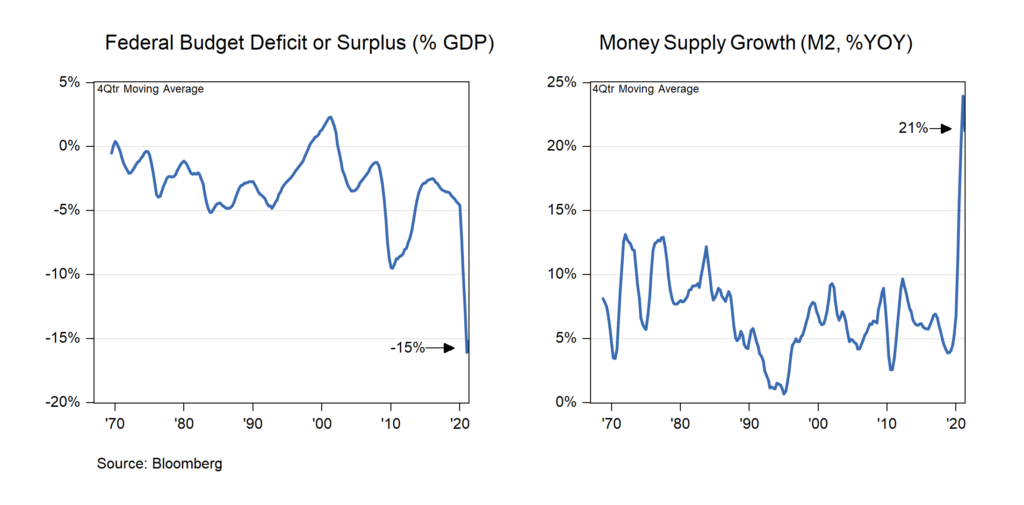

The two most direct links that may account for a structural shift in inflation comes from government action. In response to the pandemic, the Federal Government increased deficits to 15% of the economy’s size, and the Federal Reserve raised the money supply by 30% (Chart A below). Moreover, it now seems that policymakers are reluctant to pare back spending or monetary accommodation, despite vaccinations, labor shortages, and rising prices. This is a powerful one-two punch that, we think, lies at the heart of the inflation story.

Chart A

Stimulus In Full Swing

Reason to Worry

We think the Federal Reserve should worry about inflation as history proves it is hard to stop inflation once it becomes entrenched. History also shows the Fed is more capable of hitting the monetary accelerator than the brake. We view policy as overly accommodative in the face of mounting evidence of returning growth and inflation.

With the combination of near-zero rates, $120 billion of ongoing asset purchases, and forward guidance for continued low rates, the Federal Reserve promotes an environment of risk-taking. This is accomplished by encouraging borrowing and denying investors of safer investment options for savings. Risk appetite is especially evident in stock prices. The U.S. stock market just rose above $50 trillion for the first time ever. The value of stocks is up $15 trillion in a year, the most significant gain ever. At 2.3 times underlying gross domestic product, the valuation of equities relative to the economy is also at a record.

At some point, the Fed could be seen as “behind the curve” in responding to changes in inflation, markets, and the economy. This would complicate the Fed’s efforts to communicate policy changes. Thus, the central bank will likely focus its message on how they intend to reduce accommodation.

Portfolio Implications

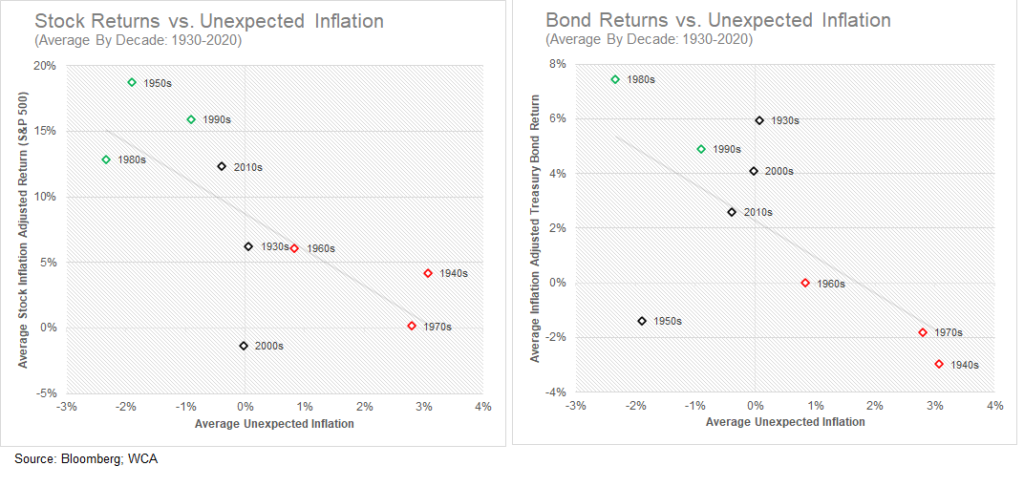

Should inflation prove to be more than temporary, unexpected inflation in the years ahead is likely. It is also expected that interest rates would rise in response and as investors demand compensation for uncertainty. We find that in periods of unexpected inflation, where actual inflation exceeds trend inflation, real stock and bond returns tend to suffer (charts B&C below).

Chart B&C

How Inflation Impacts Real Returns

But investors should be aware that some companies can also benefit from mild inflation. Those firms with pricing and balance sheet flexibility in pricing are best positioned, in our view. If a company has sufficient profitability and can raise prices faster than costs, profits can grow. Other companies who struggle to turn a profit before inflation and then encounter rising costs that can not be passed on to customers could be in trouble.

Moreover, companies who borrowed heavily on the expectation debt would be rolled over cheaply may be in for a rude awakening. If higher inflation leads to higher interest costs, then overly indebted companies will face greater default risk.

Conclusion

We believe we are nearing an inflection point on policy that will require great skill from the Fed and Congress to navigate. The economy is moving beyond pandemic level activity. Accordingly, we expect the degree of monetary and fiscal support to be dialed back. As this process unfolds, there is a risk that markets react negatively.

Portfolio strategy may require a more tactical approach and a focus on flexibility and quality.

Kevin R. Caron, CFA

Senior Portfolio Manager

973-549-4051

Chad Morganlander

Senior Portfolio Manager

973-549-4052

Matthew Battipaglia

Portfolio Manager

973-549-4047

Steve Lerit, CFA

Senior Risk Manager

973-549-4028

Tom Serzan

Analyst

973-549-4335

Suzanne Ashley

Internal Relationship Manager

973-549-4168

Eric Needham

Director, External Sales and Marketing

312-771-6010

Jeffrey Battipaglia

Client Portfolio Manager

973-549-4031

Disclosures

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.

Disclosures

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.