Safe Havens

Bond prices continue to surge, driven by coronavirus fears and a new oil price war. Prices of long-term U.S. Treasury bonds are rising rapidly, sending bond yields to record lows. Bonds at the longest end of the U.S. Treasury curve are approaching gains of 20-30% year-to-date. Similar bond price action occurred in the past, but never before have U.S. interest rates reached levels seen today. U.S. 20-year Treasury yields have now fallen through one percent, following the 10-year Treasury amid a broader global pattern of rapidly declining and ultra-low rates. The 30-year U.S. Treasury bond yield currently stands at a shockingly low 1%.

On top of virus worries, oil and energy shares are under significant pressure. Oil markets tumbled 30% after the OPEC+ countries alliance broke down and a price war broke out between Saudi Arabia and Russia. The slide in oil prices could also add additional pressure to credit markets already experiencing some signs of pressure due to coronavirus.

Flight to Safety

In times of uncertainty, markets will gravitate toward assets like Treasuries and gold. Year-to-date, long-term Treasuries are up 17%, and gold is up 10%. Large-cap U.S. stocks are outpacing emerging markets. The energy sector, highly exposed to global growth worries, is down 25% for the year. Financials, which are affected by loan demand and interest rate and market dynamics, are also down 14%. The more consistent consumer staples sector is down just 1%, and utilities, which generally benefit from lower interest rates, are up 4% as a group.

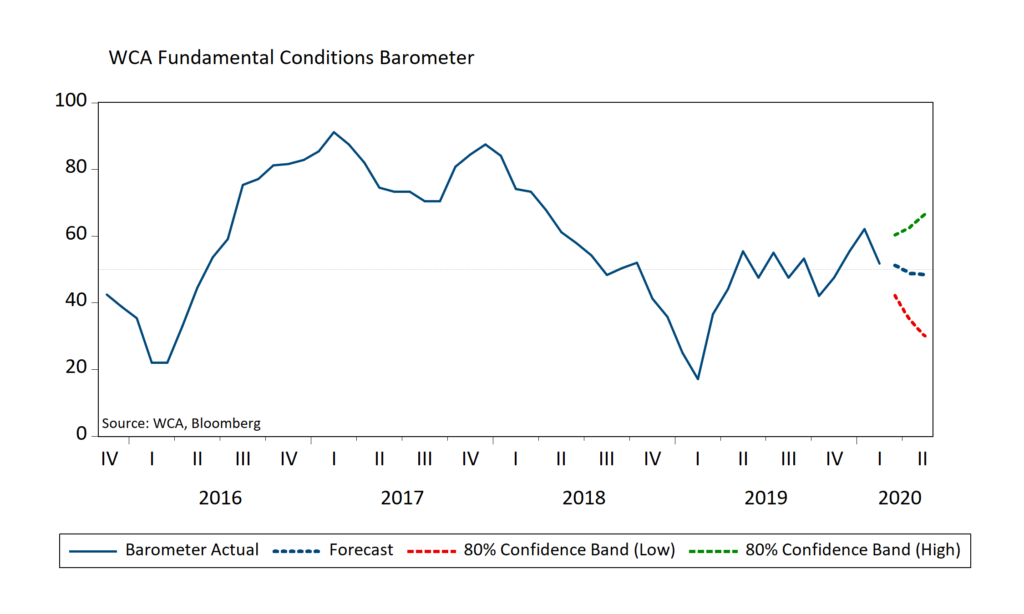

Barometer Reverses

The WCA Barometer (chart, below) lost momentum as markets and data point toward rising recession risk. The re-inversion of the bond yield curve, increase in equity volatility, and falling commodity prices tell part of the story. A fall in overall business activity through February in China and, to a lesser extent, the United States shows the rest of the story. Questions about the eventual size and duration of coronavirus’ impact on activity and confidence are essential. The next few weeks will be telling about the depth of the effects on activity. The downtick in our barometer leads us to align equity exposure close to the benchmark.

Japan

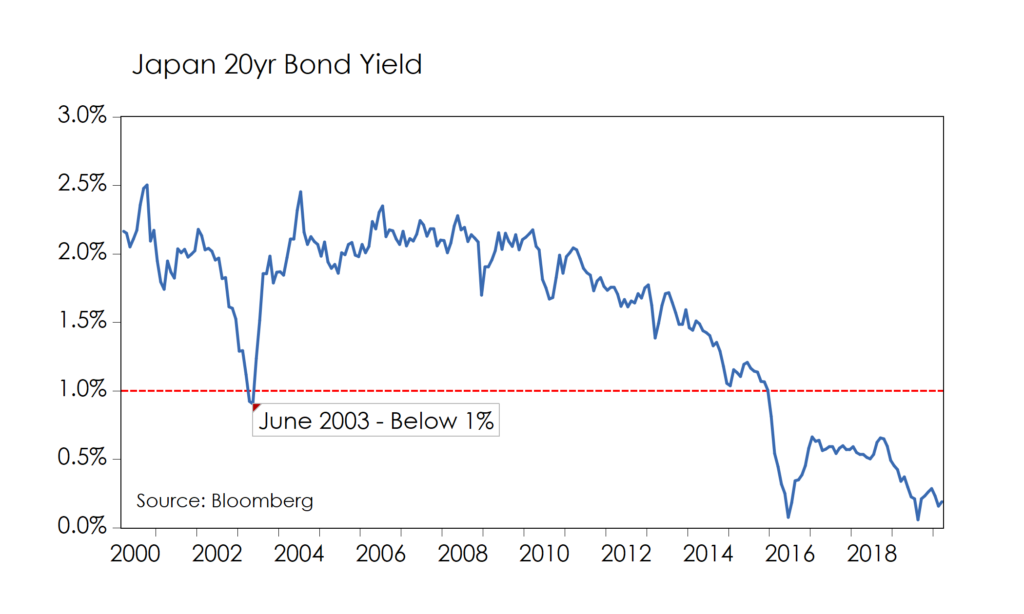

Our base case remains one where the coronavirus shock passes, but not before exacting a near-term tax on output. However, the fall in global rates has us wondering about how Japan’s markets fared after 20-year rates on Japanese Government Bond yields fell through 1% well over a decade ago.

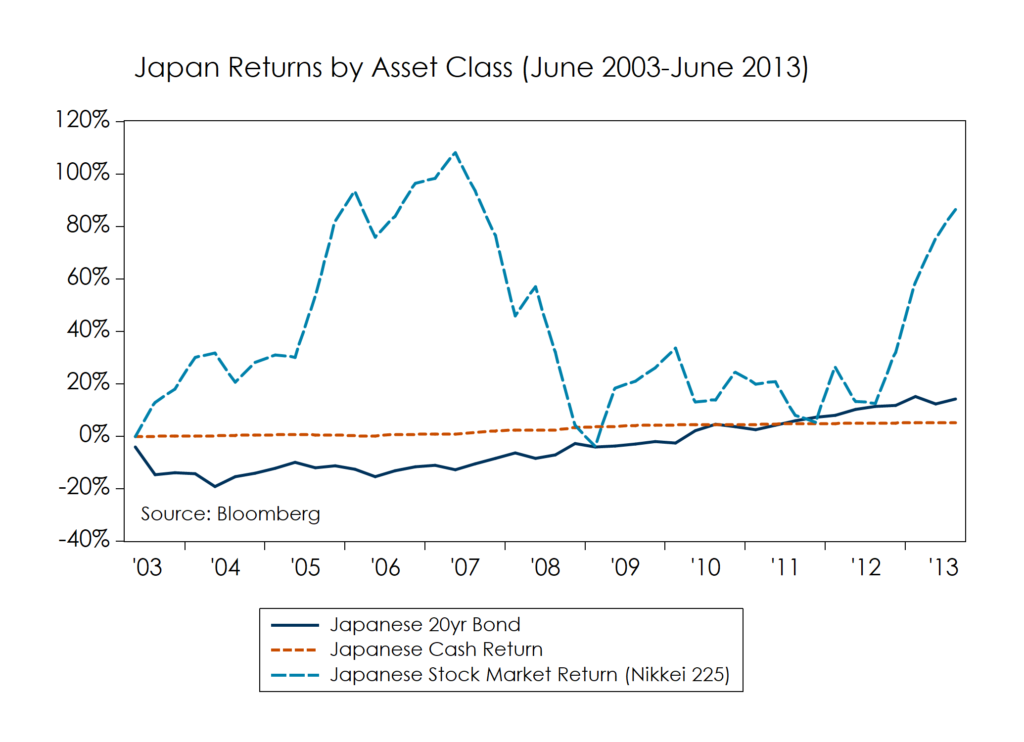

That event occurred in June 2003, just after the U.S. invasion of Iraq. For the first time, very long-term Japanese bond yields crashed below 1% as Japanese bond prices surged (top chart, below). Investors who rushed to buy the low-coupon, low-yield bonds before prices rose further were not initially rewarded. As quickly as prices rose and yields fell before June 2003, the opposite happened afterward. Once uncertainties faded and investors no longer sought safe harbors, bonds fell. For about a year thereafter, Japanese bond investors who chased sub-1% bonds in June 2003 endured losses between 15-20%. Even after yields stabilized back above 2%, it took five years to recoup losses given the low coupon rate. As bond investors earned the coupon, Japan’s stock market rallied strongly until the 2008-2009 financial crisis brought stocks around the world back down to earth.

In the end, the bond investors who held the low-yielding bonds earned a small-but-positive return during the worst recession and financial crisis seen since the Great Depression. Even with low yields, bonds provided some diversification benefits and stability. The lesson here is that a diversified approach, one that includes stocks, bonds, cash, and other assets, is often the best way to go — especially during periods of uncertainty.

Conclusion

Coronavirus and a new oil price war is going to cut into growth and raise the odds of outright contraction in some countries and sectors. Markets and central banks, confronted with an unpredictable set of outcomes, are choosing to shoot first and ask questions later. During periods of uncertainty, safe-haven assets like Treasuries and gold have been the go-to choices for nervous investors in the past. The current health crisis is no different.

We continue to focus on equities demonstrating consistent earnings, low debt, and solid profitability. We believe yield chasing and overpaying for stories and rapid growth are risky strategies that we want to avoid at all costs. Within CONQUEST portfolios, we find a diversified and tactical approach to be a good way to navigate through rough waters.

To learn more about WCA’s portfolio strategies, please visit us on the web at www.washingtoncrossingadvisors.com

Kevin Caron, CFA, Senior Portfolio Manager

Chad Morganlander, Senior Portfolio Manager

Matthew Battipaglia, Portfolio Manager

Steve Lerit, CFA, Client Portfolio Manager

Suzanne Ashley, Analyst

(973) 549-4168

www.washingtoncrossingadvisors.com

www.stifel.com

Disclosures

WCA Fundamental Conditions Barometer Description: We regularly assess changes in fundamental conditions to help guide near-term asset allocation decisions. The analysis incorporates approximately 30 forward-looking indicators in categories ranging from Credit and Capital Markets to U.S. Economic Conditions and Foreign Conditions. From each category of data, we create three diffusion-style sub-indices that measure the trends in the underlying data. Sustained improvement that is spread across a wide variety of observations will produce index readings above 50 (potentially favoring stocks), while readings below 50 would indicate potential deterioration (potentially favoring bonds). The WCA Fundamental Conditions Index combines the three underlying categories into a single summary measure. This measure can be thought of as a “barometer” for changes in fundamental conditions.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecasted in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF).