Revisiting Long-Run Views

This week: The Federal Open Market Committee (FOMC) will make an announcement Wednesday at 2:00 p.m. Eastern Time, with a press conference to follow. Greek negotiations continue. May industrial production data due out today (expectation +0.3%).

Macro View

This week will bring the Federal Reserve Board’s (Fed) next move into focus as they announce its latest policy decision on Wednesday (forecasts updated and press conference to follow). Ultimately, we expect the Fed to continue toward a September hike, given the recent firming in employment and other data.

Mixed views have been expressed recently from other members of the FOMC, but the overall message seems to remain that while the economy lost some momentum and there remains a need for continued accommodation, the Fed still plans to move ahead with at least one rate increase this year given what they know today. It is likely that the Fed will seek to quell trepidation over rate increases by flattening the future forecasted rate path when forecasts are updated Wednesday. In September of last year, for example, the FOMC expected short-term rates to reach 2.875% by the end of 2016. Now that number stands at just 1.875% and will most likely be cut again on Wednesday.

Revisiting Our Long-Run Perspective

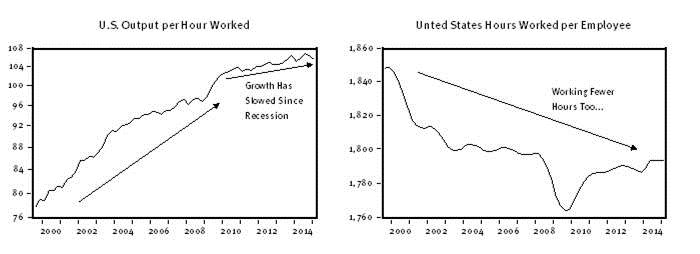

As we near mid-year with equity indices at record highs, we thought we would take this opportunity to update our long-run forecasts set out at the start of the year. These forecasts help to inform our longer-term strategic allocations. An important aspect of our top-down forecasts relates to the real growth rate for the economy which, we all know, is growing slower since the last recession. Part of the reason relates to structural changes related to labor and we will hear more about this for sure on Wednesday as part of Janet Yellen’s comments. While monetary policy can have a powerful effect on the cost of capital and prices, it can do relatively less to address issues of productivity and workforce characteristics. Output per worker and overall work hours, for example, have been (and remain) weak (chart below).

Source: Labor Department

Always tied to the economy over the long term, stock prices are a product of returns from income, real earnings growth, inflation, and to a lesser extent, expected changes in margins and multiples over time. We come to our long-run forecast by examining a series of return contributors beginning with an expected cash return in the form of dividends and net share buybacks.

A cash return can be expected from dividends and net share buybacks in the years ahead. A bottom-up estimate from Bloomberg of S&P 500 dividends is now $45.60 for the next 12 months. This implies a forward-looking dividend yield of at least 2.2% for starters. Net share repurchases also offer a real source of cash to shareholders. Since 2010, S&P 500 net share repurchases have been near $30 annually, resulting in an average net repurchase “yield” near 2.5%, which we think can continue so long as cash flow remains ample.

In addition to income return, we must account for growth. Real earnings growth should track our estimate for real domestic economic growth of 2.3% plus 0.5% for exposure to faster growing foreign earnings. Since profit margins for the S&P 500 are currently expected to average a record-high 10.4% in 2015 (21% above the 10-year average of 8.6% according to FactSet), we are deducting 2.1% from our annual return assumption to account for some slippage in profit margins as labor markets gradually tighten and wages pick up.

We also expect some small valuation adjustment. The forward 12-month price-to-earnings ratio for the S&P 500 based on analyst estimates is 16.8 times $124.64 of expected operating earnings (19% above the 10-year average multiple of 14.1). Amortizing that valuation premium over 10 years suggests a drag of 1.9% expected returns. Adding all this together with an expected inflation rate of 2% leads us to our long-run expected equity return of 5.5%.

This return is 3.1% above the current yield on the 10-year Treasury bond. This spread has narrowed since the start of the year when, our long-run expected return was 4.2% higher than the 10-year Treasury yield. On a relative basis, stocks still offer an advantage over Treasuries, but the margin of advantage has narrowed since the start of the year.

[table id=7 /]