Monday Morning Minute ~ February 4, 2019

When Patience is a Virtue

Patience is a virtue when it leads to good

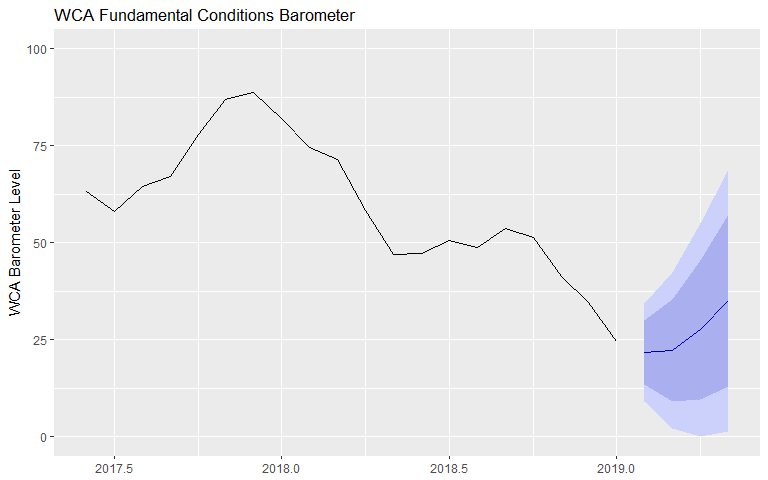

As the chart below shows, our WCA Fundamental Conditions Barometer weakened throughout 2018 and into 2019. Sustained changes across a wide array of data, measured over weeks and months, are to blame. The weakness is most acute overseas and in the area of financial conditions. Countries including Australia, Canada, France, Germany, Italy, Japan, Korea, China, and India are all exhibiting some form of weakening outlook.

The United States has been immune from most of the pain, but weakness overseas could impact our economy given enough time. Multinational firms, which make up the majority of our equity markets are already feeling the pinch from a weaker global economy. According to FactSet, first quarter earnings are now expected to be negative for S&P 500 companies, most of which are multinationals. Anecdotal evidence during fourth quarter conference calls also seemed to point to rising pressures overseas.

A Gradual Gathering of Evidence

While the market is cheering the continuation of easy monetary conditions, we remain cautious. Early last year, markets began to signal concern. First, the Treasury yield curve flattened and corporate credit spreads rose. Next, the riskier parts of the stock market, favored in 2017 and 2018, lost ground to safer segments of the market. Financial conditions began to tighten especially in Asia and Europe where concerns over trade were greatest. Commodity prices softened, reflecting lower expected global demand for industrial metals and energy inputs. By early fall, we saw weakening in domestic capital goods orders, Chinese manufacturing, and confidence indicators in Europe. Most recently, the earnings outlook for U.S. multinationals have been sharply cut by analysts.

The evidence above supports a more gradual policy response from the Fed. The Federal Open Market Committee has come around to recognize this, and we feel the Chairman delivered the right message to the markets last week.

Conclusion

While the policy shift could help lay the groundwork for an eventual turn, we are not yet at a point where the data points to clear skies ahead. Therefore, we continue to trim equity exposure in keeping with the direction of our WCA Fundamental Conditions Barometer (chart, above). Equity exposure in the short-term satellite portion of CONQUEST portfolios stand near 30%, with bonds at 70%. We continue to like domestic stocks over foreign, given the better performance of the U.S. economy compared to foreign.

Kevin Caron, CFA, Senior Portfolio Manager

Chad Morganlander, Senior Portfolio Manager

Matthew Battipaglia, Portfolio Manager

Suzanne Ashley, Analyst

Disclosures

WCA Fundamental Conditions Barometer Description: We regularly assess changes in fundamental conditions to help guide near-term asset allocation decisions. The analysis incorporates approximately 30 forward-looking indicators in categories ranging from Credit and Capital Markets to U.S. Economic Conditions and Foreign Conditions. From each category of data, we create three diffusion-style sub-indices that measure the trends in the underlying data.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecasted in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small company stocks are typically more volatile and carry additional

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance

This commentary often expresses opinions about the direction of

Washington Crossing Advisors LLC is a wholly owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF).