Monday Morning Minute 121216

THE WEEK AHEAD

The Federal Open Market Committee (FOMC) is expected to deliver an anticipated rate hike against a backdrop of firmer growth, reflation, and anticipated fiscal policy change. The December 13-14 meeting will be accompanied by forecast changes and a press conference by the Chair.

MACRO VIEW

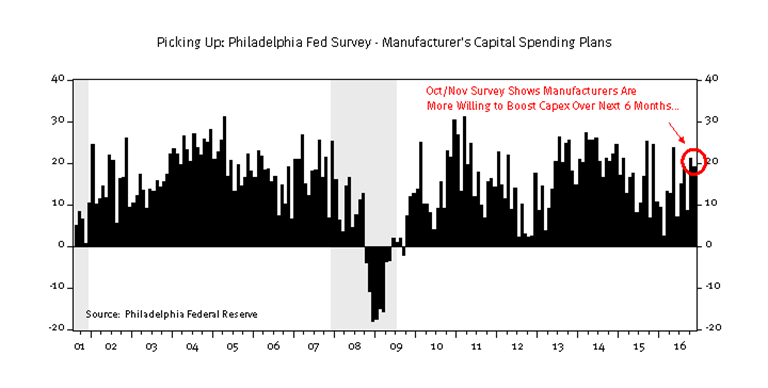

2016 is set to close in much better form than it began. The start of the year saw growth stall and investor anxiety surge; but starting around mid-year, these trends reversed course. As the year is set to close, optimism is much improved. Consumer confidence is strong, analysts are raising profit forecasts, market performance suggest investors are more risk-seeking and less risk-averse, and manufacturers expect to boost investment over the next six months (chart, below). This week’s National Federation of Independent Business (NFIB) survey of small businesses will likely suggest smaller businesses are feeling better about the outlook too.

Anticipated policy changes are now feeding into an already improving market and macroeconomic backdrop. Previously, we discussed changes to our forecast, which now sees a bump in growth in 2017-2018 as fiscal stimulus, tax reform, and regulatory reform likely boosts growth. We anticipate the full impact of fiscal changes to more fully impact 2018’s results than 2017, given the time required to make such changes. Fiscal ease should fold into 2018 forecasts, as trade and immigration issues move toward center stage. These issues are potentially the most problematic for growth, but the timing and scope of the proposals are more difficult to handicap than the domestic fiscal plan. Consequently, we are putting less weight on these issues for now.

The stock market’s 8% advance and the backing up of interest rates properly reflects an anticipated pickup in both growth and inflation. At this point, the moves do not jeopardize the growth outlook. The Federal Reserve (Fed) will undoubtedly recognize rising long-term rates, higher inflation breakevens, and rising policy rate expectations as consistent with the improved outlook. However, continued upward pressure at the long-end of the Treasury curve, further increases in inflation expectations, and an acceleration of anticipated policy rate increases could impose a near-term cost. A significant further rise in these rates, coupled with a significant further strengthening of the dollar, represents a risk scenario that could upend the markets’ recent rally and throw a wet blanket on the recent rally in risk assets.

We will watch to see how the rate paths unfold, ever mindful of the potential risks a significant further rise could impart to the outlook. Until then, we choose to focus more on the positive message contained in the improved growth, profit, and inflation outlook. We expect the Fed to adopt a similar perspective when they deliver their final rate decision of 2016 to the markets this week.

ECONOMIC RELEASES THIS WEEK

| Date | Report | Period | Survey | Prior |

| Monday, Dec 12: | Treasury Budget – Level | November | -$44.2 B | |

| Tuesday, Dec 13: | FOMC Meeting Begins | |||

| Import Prices – M/M | November | 0.5% | ||

| Export Prices – M/M | November | 0.2% | ||

| Import Prices – Y/Y | November | -0.2% | ||

| Export Prices – Y/Y | November | -1.1% | ||

| Wednesday, Dec 14: | FOMC Meeting Announcement | |||

| Fed Chair Press Conference 2:30 PM EST | ||||

| PPI-FD – M/M | November | 0.0% | ||

| PPI-FD – Y/Y | November | 0.8% | ||

| PPI-FD ex food & energy – M/M | November | -0.2% | ||

| PPI-FD ex food & energy – Y/Y | November | 1.2% | ||

| PPI-FD ex food, energy & trade services – M/M | November | -0.1% | ||

| PPI-FD ex food, energy & trade services – Y/Y | November | 1.6% | ||

| Retail Sales – M/M change | November | 0.8% | ||

| Retail Sales less autos – M/M change | November | 0.8% | ||

| Less Autos & Gas – M/M Change | November | 0.6% | ||

| Production – M/M change | November | 0.0% | ||

| Manufacturing – M/M | November | 0.2% | ||

| Capacity Utilization Rate – Level | November | 75.3% | ||

| Business Inventories – M/M change | October | 0.1% | ||

| Thursday, Dec 15: | Weekly Jobless Claims | December 10 | 258 K | |

| CPI – M/M change | November | 0.4% | ||

| CPI – Y/Y change | November | 1.6% | ||

| CPI less food & energy- M/M change | November | 0.1% | ||

| CPI less food & energy – Y/Y change | November | 2.1% | ||

| Philadelphia Fed Business Outlook Survey | December | 7.6 | ||

| Empire State Mfg. Survey | December | 1.5 | ||

| Housing Market Index | December | 63 | ||

| Foreign Demand for Long-Term U.S. Securities | October | -$26.2 B | ||

| Friday, Dec 16: | Housing Starts – Level – SAAR | November | 1.323 M | |

| Permits – Level – SAAR | November | 1.229 M |

ASSET ALLOCATION PORTFOLIO POSTURE

Based on our long-run capital market expectations, the “core” equity allocation in portfolios are underweight foreign equities / overweight large cap domestic growth, and underweight REITs / overweight Gold. The “core” bond allocation is underweight long-term Treasuries / overweight corporate high-yield bonds.

Based on shorter-term expectations, the “tactical” allocation within portfolios is underweight bonds / overweight stocks.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecasted in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small company stocks are typically more volatile and carry additional risks, since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher quality bonds. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

The WCA Fundamental Conditions Barometer measures the breadth of changes to a wide variety of fundamental data. The barometer measures the proportion of indicators under review that are moving up or down together. A barometer reading above 50 generally indicates a more bullish environment for the economy and equities, and a lower reading implies the opposite. Quantifying changes this way helps us incorporate new facts into our near-term outlook in an objective and unbiased way. More information on the barometer is found in our latest quarterly report, available at www.washingtoncrossingadvisors.com/insights.html.