Marsh McLennan (NYSE: MMC) Q3 ’22

July 13, 2022 | New York, NY

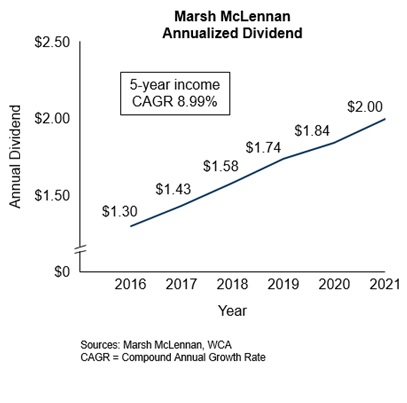

The board of directors of Marsh McLennan (NYSE: MMC) has declared a regular quarterly dividend of $0.59 per common share, an increase of approximately 10.3% from the previous quarterly dividend of $0.535.

Year to date, this marks the twentieth dividend announcement for the Washington Crossing Advisors Rising Dividend portfolio. All twenty changes were increases. The average dividend increase was 8.28% compared with December 31, 2021 indicated levels.

From the press release: “The Board of Directors of Marsh McLennan (NYSE: MMC) today declared a

10.3% increase in the quarterly dividend from $0.535 to $0.590 per share on outstanding common stock, payable on August 15, 2022, to stockholders of record on July 28, 2022.” 1

About the company: “Marsh McLennan (NYSE: MMC) is the world’s leading professional services firm in the areas of risk, strategy and people. The Company’s 83,000 colleagues advise clients in 130 countries. With annual revenue of approximately $20 billion, Marsh McLennan helps clients navigate an increasingly dynamic and complex environment through four market-leading businesses. Marsh provides data driven risk advisory services and insurance solutions to commercial and consumer clients. Guy Carpenter develops advanced risk, reinsurance and capital strategies that help clients grow profitably and pursue emerging opportunities. Mercer delivers advice and technology-driven solutions that help organizations redefine the world of work, reshape retirement and investment outcomes, and unlock health and wellbeing for a changing workforce. Oliver Wyman serves as a critical strategic, economic and brand advisor to private sector and governmental clients. For more information, visit marshmclennan.com, follow us on LinkedIn and Twitter or subscribe to BRINK.” 1

IMPORTANT DISCLOSURES: The securities discussed herein do not represent all of the securities held by the WCA Rising Dividend Portfolio as of the date presented and are subject to change at any time, without notice. A complete list of holdings as of the date noted above will be provided upon request. The above is presented to illustrate the application of the strategy only and not intended as personalized recommendations of any particular security. The securities identified and described above do not represent all of the securities purchased, sold, or recommended for client accounts. You should not assume that an investment in any of the securities identified was or will be profitable. Changes in market conditions or a company’s financial condition may impact the company’s ability to continue to pay dividends. Companies may also choose to discontinue dividend payments. All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.