Illusion and Reality

Our economy grows decade to decade, with corporations capturing an increasing share of global income in the form of profits in recent years. Along the way, low interest rates prompted growth, encouraged risk-taking, and pumped up the value of future profits. It is not surprising, then, that stocks have enjoyed a historic rise, achieving great returns far above other asset classes. Not even a global pandemic was able to short-circuit this wealth creation process. In this week’s commentary, we revisit an old idea — namely that real factors dominate growth and stock returns in the long-run, while illusory factors can dominate market behavior in the short run.

Real Growth

Over the very long run, the size of the economy matters most for stock values. Chart A below shows how stock values tend to move over time along with the economy’s size. While the relationship is not perfect from year to year, it is evident that the two are linked over long periods. Momentum and other factors can cause stocks to deviate temporarily from underlying economic fundamentals, but over longer periods, stock values remain rooted in economic fundamentals. Thus, we think it is safe to say that markets tend to be fairly rational over very long periods, as overall stock values tend to be linked to the size of the economy from which profits flow.

Chart A

Stock Values Linked to Economy Over Time

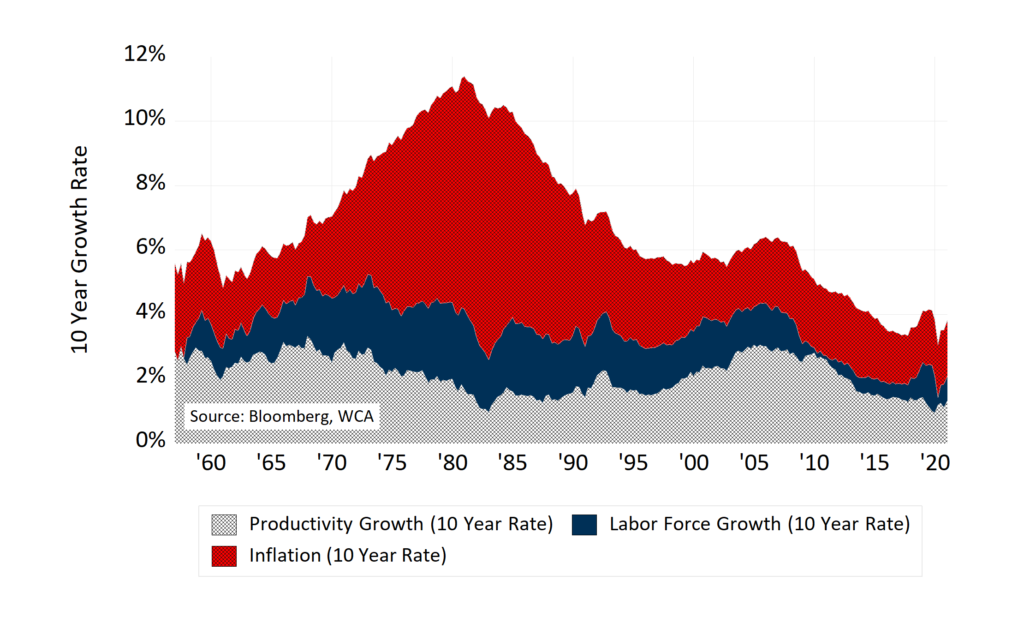

So what are the “real” factors that drive growth in the economy, and by extension, stocks? Labor plays an essential role in fueling growth, of course. A growing population and the desire and willingness for work go a long way to determine the economy’s size. By the same token, investment and productivity also add to growth. The combination of workers, capital, and productivity provides the basis for “real” growth.

In the years since the financial crisis, growth in labor and productivity slowed along with inflation (Chart B below), resulting in slower real (inflation-adjusted) and nominal (not inflation adjusted) economic growth rates. Yet, the slowing growth was not accompanied by low stock returns. Instead, stock returns have been high over the past decade.

Chart B

Productivity and Labor Force Growth Slow (Along With Inflation)

Illusory Growth

On the other hand, the creation of money through borrowing can create an illusion of growth when, in fact, little or no actual growth took place. Cycles of boom and bust often follow such significant fluctuations in borrowing and spending, mainly because forecasting becomes difficult or impossible during the process. Extrapolation and overestimation by investors and business leaders can become common, and disappointment tends to follow. This is how well-intended policies, often designed to reduce risk, can end up creating volatility as an unintended consequence. In most cases, a process of correction follows, resulting in negative returns and higher risk.

Since the past year was full of well-intended policies to support growth during the COVID-19 pandemic, a case can be made that a period of correction could be more likely now than before the pandemic.

A Year of Extraordinary Government Action

Last year, when 23 million Americans lost gainful employment, real household income fell by $121 billion, or 1%. However, government payments increased 55% to $4.8 trillion, driving total income up over 9%, the most on record. To finance the transfers, the government issued $4.8 trillion of new federal debt.

Alongside these actions, the Federal Reserve purchased $3.6 trillion of government and mortgage debt to accommodate the past year’s transfer payments and provided liquidity to other critical markets. In addition, the federal government, through the Small Business Administration, began the $953-billion Paycheck Protection Program for businesses. As you can see, the government’s economic response to COVID-19 was rapid and well-coordinated.

As a result of these and other measures, the money supply and commercial bank deposit balances expanded by a staggering 30% (Chart C below). Given this rise in newly created money, we should not be surprised to see higher prices across the economy. As the economy opens and velocity — the speed at which dollars circulate in the economy — picks up (Chart D below), some worry about inflation. Inflation is a risk factor, but the ultimate impact of COVID-19 policies on inflation will take time. We need to know more about spending, taxes, and the central bank’s willingness to finance continually large deficits, in order to assess whether higher inflation is “transient” or permanent.

Charts C & D

U.S. Money Supply Grows 30% as Economic “Velocity” Slumps

Good For Now, Possible Trouble Later

As the economy reopens and pent-up demand is released, growth should appear strong, and it does. As of this writing, the Federal Reserve Bank of Atlanta’s GDP Now model is tracking 10% growth for the second quarter. In the same way, Wall Street analysts expect S&P 500 company profits to rise 33% this year and 10%-12% each of the next two years.

At the same time, markets continue to expect interest rates to remain near zero for some time to come. Most investors seem to be expressing a very high degree of confidence in the outlook as reopening unfolds and this confidence is apparent in market valuations. From credit spreads to equity market valuations to professional forecasters, almost everywhere we look, the message is one of resounding confidence and optimism over the outlook.

Some Reason for Caution

Of course, we have seen such confidence before suddenly and unexpectedly erode when reality fails to meet lofty expectations. Credit and business cycles still exist and can shift without warning, sometimes creating unanticipated risks for stock investors. Because of this, we believe it is essential to maintain a discipline for addressing risk during both good and bad times, and why we regularly seek to invest only in profitable, consistent, well-capitalized businesses. We find such companies capable of growing when times are good while maintaining attractive defensive characteristics when markets sour.

Conclusion

In due time, we expect COVID-19 era policy supports will be wound down, and markets will move from illusory growth drivers to real growth drivers. Although today’s investing skies appear sunny and blue, risks remain. Therefore, we should ready portfolios for potential storms by avoiding low quality stocks and investing fads in favor of durable quality, flexibility, and value.

Kevin R. Caron, CFA

Senior Portfolio Manager

973-549-4051

Chad Morganlander

Senior Portfolio Manager

973-549-4052

Matthew Battipaglia

Portfolio Manager

973-549-4047

Steve Lerit, CFA

Senior Risk Manager

973-549-4028

Tom Serzan

Analyst

973-549-4335

Suzanne Ashley

Internal Relationship Manager

973-549-4168

Eric Needham

Director, External Sales and Marketing

312-771-6010

Jeffrey Battipaglia

Client Portfolio Manager

973-549-4031

Disclosures

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.

Disclosures

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.