Half Full

Reopening the economy has stirred some optimism amid a wash of depressing forecasts. The Federal Reserve Banks of Atlanta and St. Louis have a model that estimates the U.S. economy may contract at a 42-48% annualized rate in Q2. For a more optimistic read, the Federal Reserve Bank of New York “Nowcast” estimates a 31% pace of decline in Q2. Thirty-six million lost jobs and record drops in both industrial output (-11% April) and retail sales (-16% April) are driving the slump. The second quarter is going to be a bad one, but recently markets seem to be looking beyond current troubles, choosing instead to view the glass as being half full rather than half empty.

The optimism began with unprecedented government stimulus and central bank support last month. In recent days, a few positive trends in higher-frequency data served to further strengthen confidence. Coronavirus cases and deaths are slowing; jobless claims fell again last week; earnings forecasts are declining more gradually; and signs of movement on the roadways and skies are apparent. Reopening society and the economy has taken center stage, setting a more positive tone.

We believe a staggered reopening should help remove some uncertainty. But how entirely consumers come back will depend on the path of the virus, the duration of compensation losses, and a host of behavioral considerations. For now, however, progress toward reopening without a resurgence of cases is a welcome sign that means we should view the glass as half-full.

Watch Credit

Last Friday, the Federal Reserve (Fed) issued it’s twice-annual “Financial Stability Report.” In it, the Fed surveyed contacts at banks, investment firms, academic institutions, and political consultancies about key risks. They listed corporate debt and the credit cycle at the top of their list of concerns right after Covid-19 and the efficacy of policy responses. Corporate debt and credit was a more considerable concern than the U.S. election, geopolitics, China’s slowing economy, or even trade. Rising debt levels mean we need to keep a close eye on how the economy feeds into defaults and credit quality.

That this concern was highlighted in the report is notable because the respondents identified the role elevated government and corporate debt levels could play in amplifying stress in a prolonged downturn. Respondents expressed grave concern that a recession brought about by the virus could expose highly levered parts of the economy, especially energy. Defaults could also rise, they said, because of growth in leveraged loans, private credit, and BBB-rated corporate bonds. To address this worry, the government and the central bank are undertaking extraordinary measures to maintain incomes and preserve market access to credit.

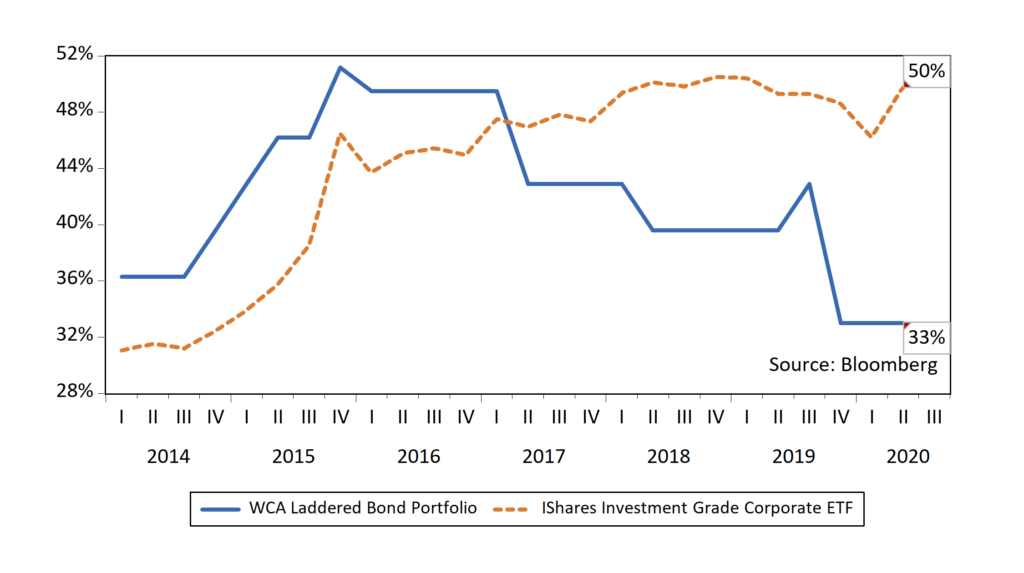

But under the risk case of a longer downturn, downgrades and defaults could become more common. This risk is further amplified by elevated existing levels of debt. Note that the share of investment-grade corporate bonds rated BBB — the lowest rung of investment grade debt — has increased sharply in recent years. The percentage of the iBoxx Investment Grade Corporate bond index invested in BBB-rated issues, for example, stands at 50% now versus 36% five years ago. To push against this trend, we sought to reduce the weighting in BBB-rated issuers in the Washington Crossing Advisors 1-10 Year Corporate Bond Ladder portfolio (chart, below). The goal in doing this was to maintain a steady credit quality in the portfolio, especially as the economic cycle lengthened and debt levels rose.

Exposure to BBB-Rated Corporate Bonds (% Weight)

CONQUEST Tactical Portfolio Positioning

We further raised the equity exposure in the CONQUEST tactical sleeves last week based on new data. Portfolio equity exposure is now near benchmark weights. We think this is an appropriate positioning because the S&P 500 is near the midpoint of this year’s range and because data trends are mixed. The tactical tilts in the core of the CONQUEST portfolios remain:

- Overweight domestic versus foreign

- Overweight developed vs. emerging

- Overweight value vs. growth

- Overweight gold

- Underweight high-yield corporate bonds

Conclusion

The economy is undergoing an unprecedented shock. That shock is firstly a health crisis, but also contains elements of a natural disaster with recession dynamics. We are uncertain how the path of the virus will play out in the months ahead. Therefore, to navigate through, we not only maintain a long-term view, but also rely on the unbiased assessment of incoming data and focus on quality in security selection. For now, progress toward reopening without a spike in Covid-19 cases will be seen as a win. A half-full attitude seems appropriate, but further evidence of progress must now follow.

Disclosures:

The Washington Crossing Advisors’ High Quality Index and Low Quality Index are objective, quantitative measures designed to identify quality in the top 1,000 U.S. companies. Ranked by fundamental factors, WCA grades companies from “A” (top quintile) to “F” (bottom quintile). Factors include debt relative to equity, asset profitability, and consistency in performance. Companies with lower debt, higher profitability, and greater consistency earn higher grades. These indices are reconstituted annually and rebalanced daily. For informational purposes only, and WCA Quality Grade indices do not reflect the performance of any WCA investment strategy.

Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely regarded Standard & Poor’s 500 Index, which is generally considered representative of the U.S. large capitalization market. The index has the same constituents as the capitalization-weighted S&P 500, but each company in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.