Central Bank to Cut Rate

We expect the Federal Reserve to cut rates this week by 0.25% — the first cut since 2007. Last week, the European Central Bank signaled a willingness to cut rates and buy assets. Both banks are responding to signs of slower global growth and weakening trade. These actions would mark a turnaround in messaging from a year ago. At that time, most were expecting global rates to move higher as growth kept on an upward path.

A Fine Line

The central banks must walk a fine line between voicing a worrying message about growth and providing “insurance” against a potential future downturn. The difficulty here comes from conflicting data. Most of the data we’ve seen lately tends to support the idea that growth continues, albeit at a more modest pace. Employment and market-based indicators point to growth and tightening capacity, on the one hand. Manufacturing and trade data suggests some weakness on the other. The data, taken as a whole, still seems to be leaning in the direction of continued growth.

Take last week’s U.S. Gross Domestic Product figures, for example. In the second quarter, the U.S. economy grew at an annualized rate of 2.1%. The first half growth rate now stands near 2.6%, above our 2.5% full-year expectation.

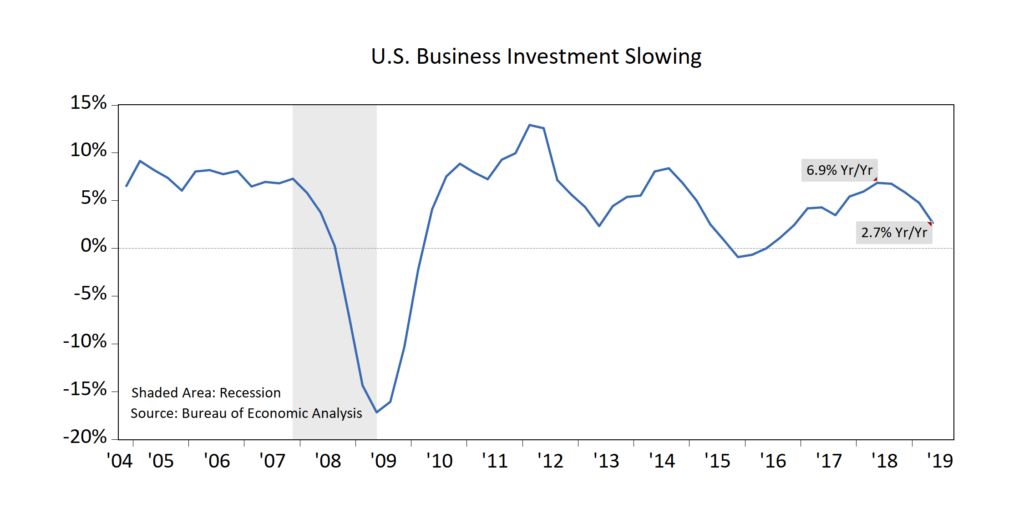

Within the report, we saw good strength in consumption, which grew at a 4.3% annualized pace. Business investment was a headwind; however, as non-residential fixed investment fell at a 0.6% annualized pace. The year-over-year growth in business spending has slowed to 2.7% through the second quarter versus 6.9% about a year ago (chart, below). Investment in inventory rose, which could weigh on growth in the second half of the year. A purer measure of domestic demand, called “final sales to domestic purchasers”, was also steady — that measure expanded by 2.3%, which is consistent with constant, ongoing growth. All-in-all, we see the report as a solid one.

Next Week

Next week we expect to have an update to our WCA Fundamental Conditions Barometer. The overall tone of data has been better than at the start of the year, but far from robust. This week we will get data on industrial production in Japan and the latest spending data in the United States. These data points will round out our observation set that goes into the near-term forecast of our barometer.

Kevin Caron, CFA, Senior Portfolio Manager

Chad Morganlander, Senior Portfolio Manager

Matthew Battipaglia, Portfolio Manager

Steve Lerit, CFA, Client Portfolio Manager

Suzanne Ashley, Analyst

(973) 549-4168

www.washingtoncrossingadvisors.com

www.stifel.com

Disclosures

WCA Fundamental Conditions Barometer Description: We regularly assess changes in fundamental conditions to help guide near-term asset allocation decisions. The analysis incorporates approximately 30 forward-looking indicators in categories ranging from Credit and Capital Markets to U.S. Economic Conditions and Foreign Conditions. From each category of data, we create three diffusion-style sub-indices that measure the trends in the underlying data. Sustained improvement that is spread across a wide variety of observations will produce index readings above 50 (potentially favoring stocks), while readings below 50 would indicate potential deterioration (potentially favoring bonds). The WCA Fundamental Conditions Index combines the three underlying categories into a single summary measure. This measure can be thought of as a “barometer” for changes in fundamental conditions.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecasted in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small company stocks are typically more volatile and carry additional risks, since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

Washington Crossing Advisors LLC is a wholly owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF).