What Price for Quality?

Easy money policies and rising debt lead us to focus on quality first. In past commentaries, we made a case for owning high-quality firms over low and offer an alternative to “growth and value.” This week, we want to explore how we think about what we pay to own high quality.

How We Asses Quality

When we say “quality,” we really mean flexibility, resilience, and consistency. To find these characteristics, we test firms for low debt, productive assets, and operating consistency. Each quarter we examine the largest 1,000 U.S. companies along these lines, rank the results, and assign quality grades as follows:

WCA Quality Grade Quintiles:

- Top 20% = “A-Quality”

- Next 20% = “B-Quality”

- Next 20% = “C-Quality”

- Next 20% = “D-Quality”

- Bottom 20% = “F-Quality”

We then create and track the performance of each group month by month in a proprietary equally-weighted index. It is fascinating to compare the difference in performance between the “A-Quality” and “F-Quality” groups in different market environments. During powerful rallies, the low-quality group often leads the market. During sideways and down markets, high-quality tends to lead. This was precisely the pattern seen from the onset of the pandemic to today, and in many previous cycles.

Most importantly, understanding the quality of the investment is essential to understanding and addressing risk. Over the long run, we see higher-quality firms tend to show the resilience that lower-quality firms often struggle to demonstrate. Also, we expect “high” to outperform “low” quality when markets are uncertain. In uncertain times, investors tend to look for “A-quality” firms’ flexibility and predictability.

Recent Experience

After several solid years for high-quality stocks, low-quality stocks have played catch up. Chart A below shows how high and low-quality companies performed over the past five- and one-year periods. Over the last five years, “A-quality” outperformed, returning 150% versus 65% for “F-Quality,” but not this past year. After underperforming at the start of the pandemic, the lowest quality stocks surged on stimulus and vaccinations, returning 63% versus 36% for the highest quality companies over the past year.

Chart A

WCA Quality Grade Category Performance

But this trend could be turning. Since the end of May, we notice that “A-Quality” companies are up 6% compared to -6% for “F-Quality.” It may be too early to call the “junk-led rally” over, but it seems that investor preferences just might be starting to show signs of change.

The Price of Quality

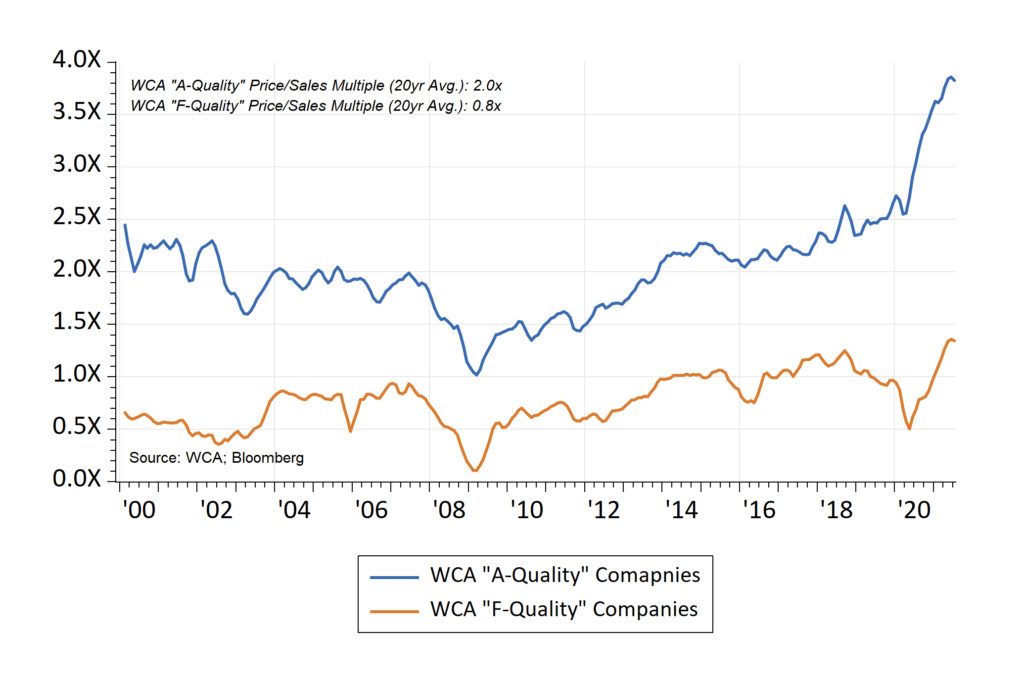

How should we think about the price paid for quality? It makes sense that higher-quality firms would trade at a premium, but how much of a premium? To answer this, we start by looking at the average price-to-sales ratio for high- and low-quality companies (Chart B below). Based on this rudimentary ratio, we see that quality seems to carry a significant premium. That premium is consistent from year to year and appears to have grown recently.

Chart B

Valuation: Price to Sales Ratio

But is this really the right way to think about price? Is the “price-to-sales ratio” telling the whole story? We do not think so, and we believe owning high-quality shares may not be nearly as expensive as it appears when viewed correctly.

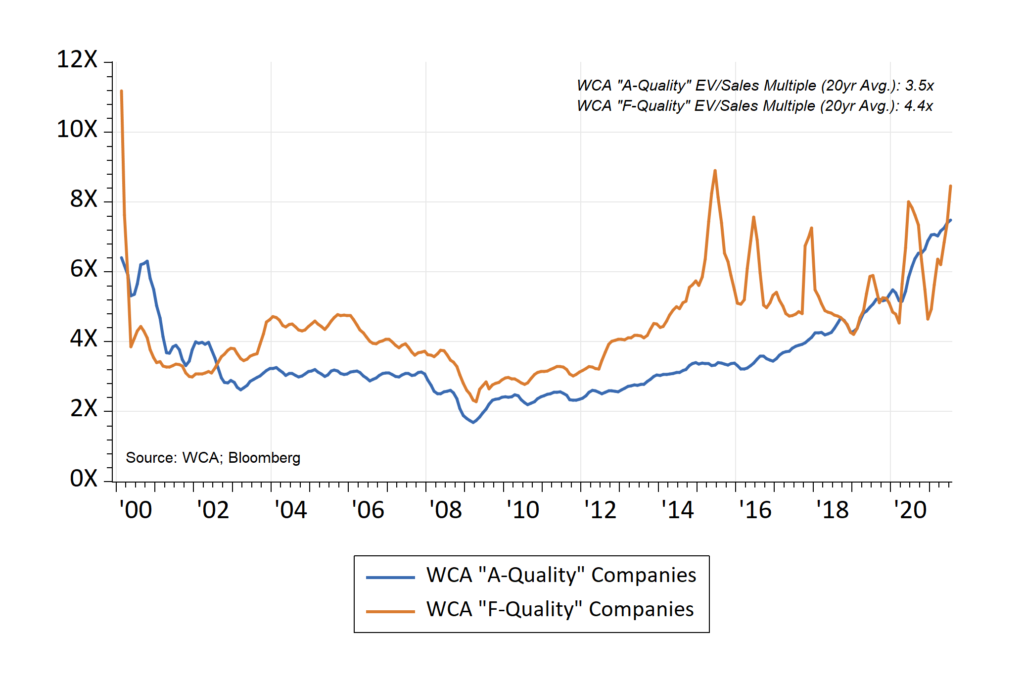

Don’t Forget Debt

To see why high-quality may not be that expensive after all, consider that the “price-to-sales ratio” only looks at the stock price and revenue per share. The ratio completely ignores company debt, which is senior to equity in a firm’s capital structure and is often a major contributor to unexpected risk. To fix this oversight, all we need to do is add debt per share (net of cash) to the stock price. The resulting figure is called “enterprise value,” which we then divide by sales. This debt-adjusted ratio, called “enterprise value to sales,” is a better and more complete valuation metric than “price to sales,” in our view.

The “enterprise-value-to-sales ratio” chart (Chart C below) paints a much different picture. After including debt, the hefty premium for quality seems to disappear entirely. In fact, the last year’s 63% “F-Quality” rally now pushes the valuation ratio up above that of “A-Quality” stocks. Viewed in this light, we conclude investors are now better paid to own high over low-quality shares.

Chart C

Valuation: Enterprise Value to Sales

Winds of Change?

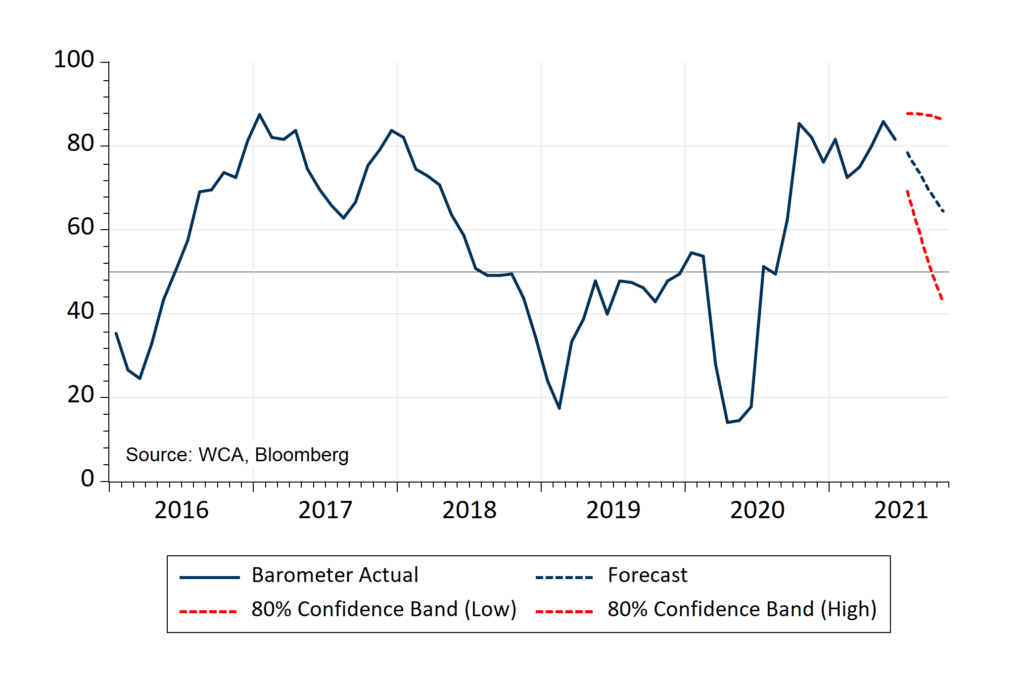

Our WCA Barometer (Chart D below) continues to point to growth and robust market conditions. This barometer is updated monthly based on incoming market and economic data and helps us assess market trends. Readings above 50 generally are bullish for stocks and forecast near-term growth. Readings below 50 are more bearish.

As you can see, this month’s forecast sees some slippage ahead. After many months of strong economic and market trends, supported by government spending, low interest rates, and central bank asset purchases, expectations are high. A misstep on policy or market re-appraisal of expectations could lead to an uptick in volatility.

Chart D

WCA Fundamental Conditions Barometer

Time for Quality

Under this scenario, we believe the recent shift to high-quality market leadership could continue. We cannot know for sure if this month marks the start of a market phase led by high-quality. However, we have seen time and again that credit-driven and debt-driven market rallies are subject to sharp reversals. This was the case in late 1999 and late 2007, just before the 2000-2002 Nasdaq Bust and 2008 Financial Crisis.

Over time, quality has proven itself by delivering solid risk-adjusted returns and relative valuations appear reasonable when factoring in debt. For these reasons, we believe that a focus on high-quality, flexible firms makes sense now. Today’s market valuations and a potential change in market narrative, creates an opportunity to revisit the “quality” theme.

WCA Fundamental Conditions Barometer:

We regularly assess changes in fundamental conditions to help guide near-term asset allocation decisions. The analysis incorporates approximately 30 forward-looking indicators in categories ranging from Credit and Capital Markets to U.S. Economic Conditions and Foreign Conditions. From each category of data, we create three diffusion-style sub-indices that measure the trends in the underlying data. Sustained improvement that is spread across a wide variety of observations will produce index readings above 50 (potentially favoring stocks), while readings below 50 would indicate potential deterioration (potentially favoring bonds). The WCA Fundamental Conditions Index combines the three underlying categories into a single summary measure. This measure can be thought of as a “barometer” for changes in fundamental conditions.

Disclosures:

The Washington Crossing Advisors’ High Quality Index and Low Quality Index are objective, quantitative measures designed to identify quality in the top 1,000 U.S. companies. Ranked by fundamental factors, WCA grades companies from “A” (top quintile) to “F” (bottom quintile). Factors include debt relative to equity, asset profitability, and consistency in performance. Companies with lower debt, higher profitability, and greater consistency earn higher grades. These indices are reconstituted annually and rebalanced daily. For informational purposes only, and WCA Quality Grade indices do not reflect the performance of any WCA investment strategy.

Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely regarded Standard & Poor’s 500 Index, which is generally considered representative of the U.S. large capitalization market. The index has the same constituents as the capitalization-weighted S&P 500, but each company in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.