Reexamining Quality

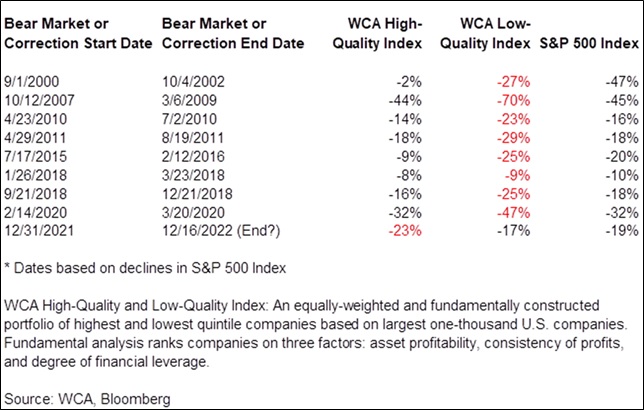

High-quality stocks beat low-quality stocks in every problematic market for the past twenty years, but not in 2022 (table below). In each bearish phase, high quality held up better than low. However, this was not the case this year. Year-to-date, the WCA High-Quality index is down 15%, while the WCA Low-Quality index is down just 5%. While this trend is changing with recent performance once again favoring high quality (more on this below), this year’s performance of high-and-low quality needs some examination.

High vs. Low-Quality Performance in Bad Markets

Before doing so, we remind readers that quality is important but just one aspect of good portfolio construction. We also care greatly about the price paid; otherwise, we just introduce risk by another route. And valuations were an obvious problem by the end of 2021. To understand why, please see these articles written in late 2021, where we described the issue in detail:

- Five Reasons for Caution (December 6, 2021)

- Beta Revisited (November 29, 2021)

- What Matters Most (November 23, 2021)

A year on, we now conclude that high valuations, mostly among technology names, are less of an issue. In addition, high quality is again outperforming, relative valuations are better, and attention is starting to shift to concerns about global growth.

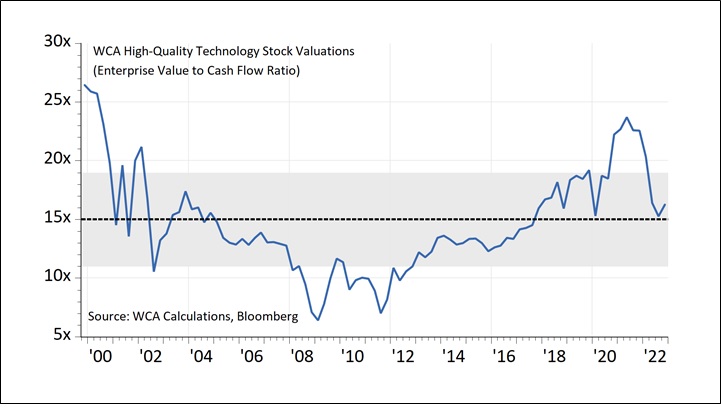

How We Got Here: The ‘20-21 Flight to Quality

The shutdown and onset of the pandemic in 2020 ushered in a different way of life. Unprecedented stimulus collided with global supply shocks as society reorganized around remote work. To survive, the world turned to communication technology, distributed networks, and remote work. Earnings for the technology sector exploded, growing by more than 50% in 2021. Valuations for technology companies within our WCA High-Quality index soared to levels not seen since the tech bubble of 2000. At the peak in 2021, the total value of these firms, including debt, was 24 times cash flow — 60% above the 20-year average of 15 times (chart below).

Valuations Return to Earth for High-Quality Tech

With vaccinations rolled out and policy stimulus drying up, technology struggled in 2022. The technology-heavy Nasdaq Composite Index is down 31% for the year. Our WCA High-Quality index’s average high-quality tech stock is down 18% this year, in line with the market’s 19% decline. We describe these firms as “high quality” because they tend to have consistent and highly profitable assets with little or no debt. These characteristics make for more flexible, durable, and predictable businesses. All else being equal, the same elements can nurture sustainable growth and may point to a competitive “moat.”

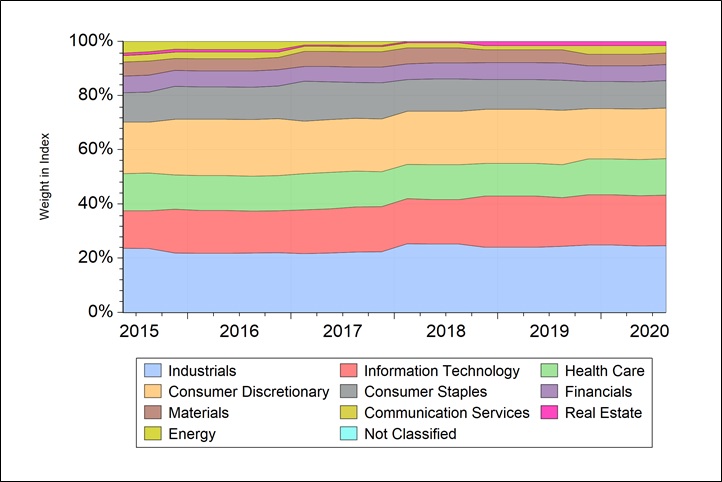

All About Technology?

The preceding might lead us to think quality investing is all about technology, but we would be wrong to think that. In fact, our WCA High-Quality index, an equally-weighted index of consistent, profitable, low-debt businesses, is consistently dominated by a mix of industrials, technology, healthcare, and consumer companies (graph below).

A Sector View: WCA High-Quality Index

A recession or worsening financial market conditions would likely harm lower-quality, commodity-driven, or highly leveraged companies more. Sectors like these, notably energy and financials, depend more on commodity prices and financial engineering to generate returns. Conversely, higher-quality companies rely less on commodity prices and financial leverage, so they should show more flexibility and resilience in a recession.

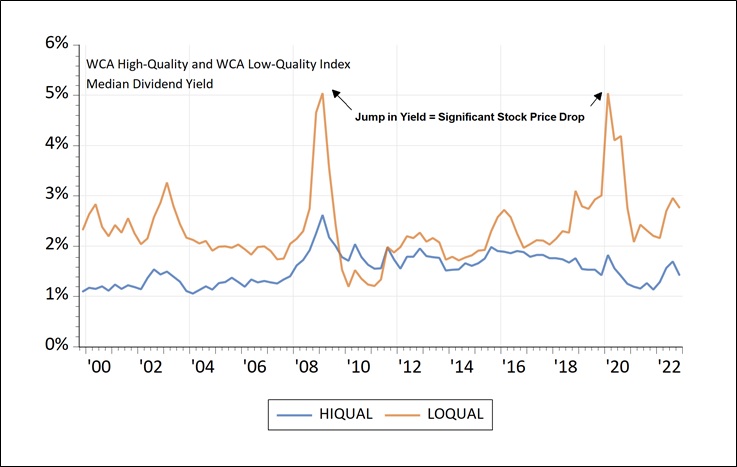

Low Quality / High Yield

As the world contemplates recession, we are reminded of another significant relationship. Time and time again, we see that high dividend-yielding companies also tend to be low-quality. Moreover, these low-quality companies tend to get hurt the most when business conditions unexpectedly deteriorate.

Just look at the graph of dividend yields below. See that lower-quality companies usually come with higher dividend yields. But also notice how those yields soar in times of stress. This means that the prices of these stocks suffered more rapid and significant declines than those of higher-quality stocks under pressure. The adage, “you get what you pay for” comes to mind when buying dividend yield. High-yield stocks, like high-yield bonds, tend to go hand-in-hand with higher risk.

Yield Behavior: High-Quality vs. Low-Quality

Turning Point?

Changing leadership and better valuations for high-quality technology stocks suggest a turning point at hand. Since June, when the Treasury yield curve inverted (signaling higher recession odds), the WCA High-Quality index declined just 1%, while the WCA Low-Quality Index fell over 7%. We conclude that now is the time to reconsider high-quality in all its forms, including technology.

Ultimately, understanding the role of quality is critical for understanding risk. While high starting valuations did pose a challenge for many high-quality stocks in 2022 (i.e., high-quality technology), we now see this as a fading issue. We should be bold in pursuing high quality where valuations make sense. We will continue seeking the highest total return possible from companies we view most likely to generate the least amount of risk. Quality at the right price was, is, and always will be how we pursue this goal.