Hints of Progress

A small glimmer of hope is concealed in recent data trends.

Here are a few examples:

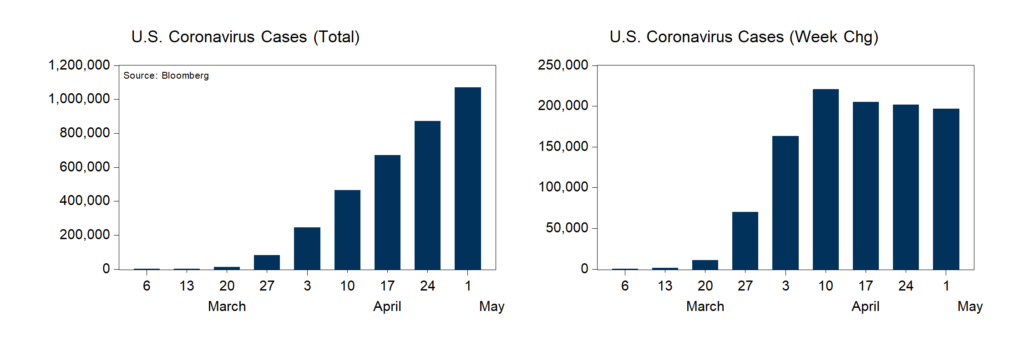

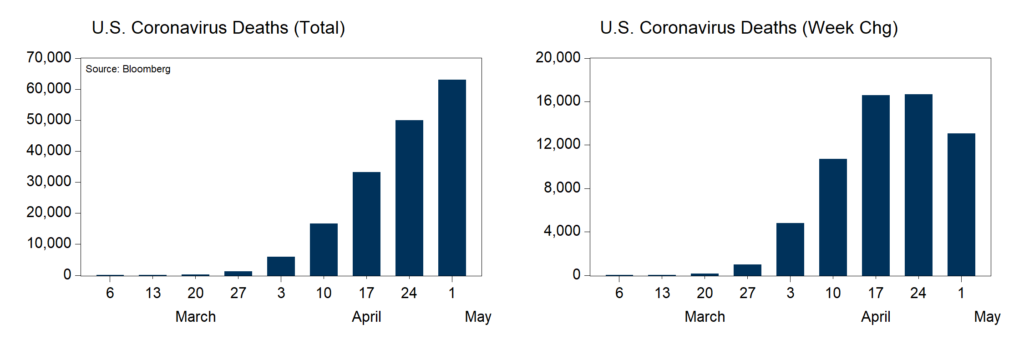

- The number of Covid-19 U.S. cases fell for the fourth week in a row (chart A, below), and deaths decreased for the first time last week (chart B, below).

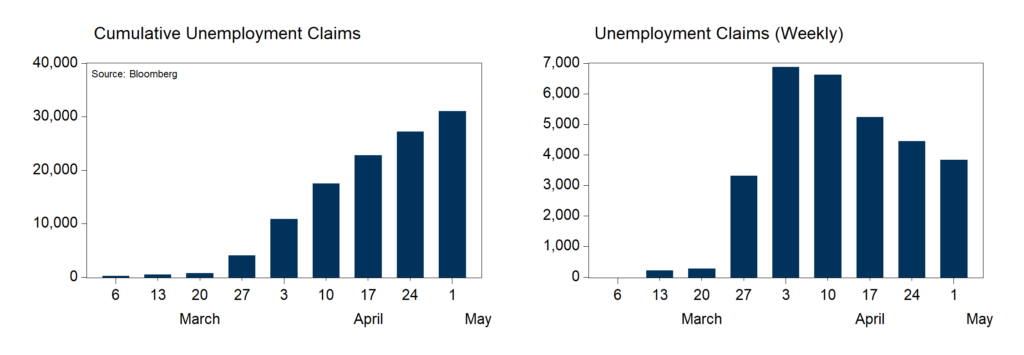

- Unemployment insurance claims also fell for the fourth consecutive week (chart C, below).

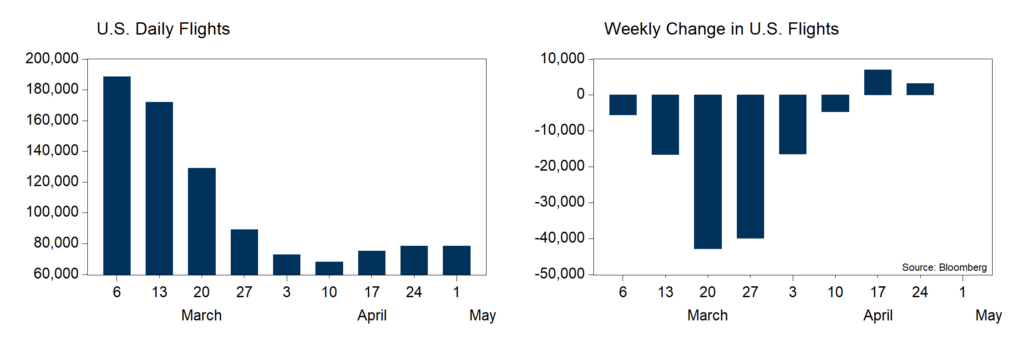

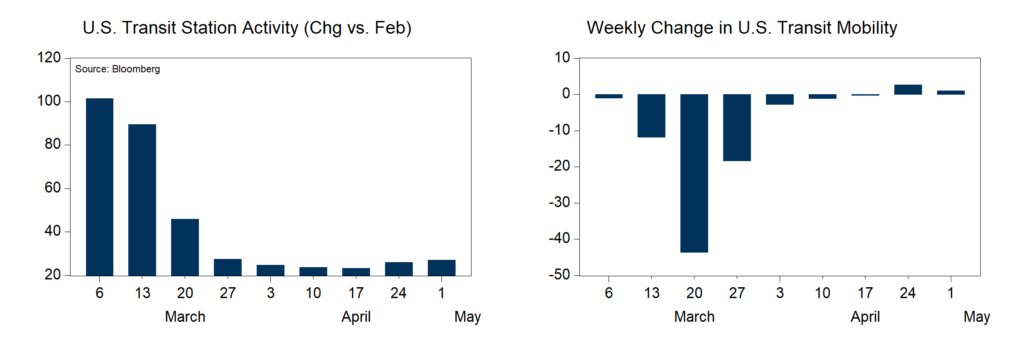

- Domestic air traffic posted small gains last week (chart D, below) as did transit hubs (chart E, below).

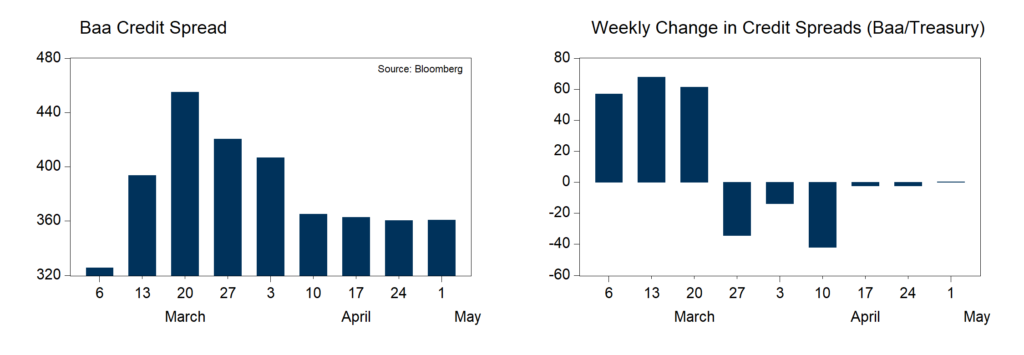

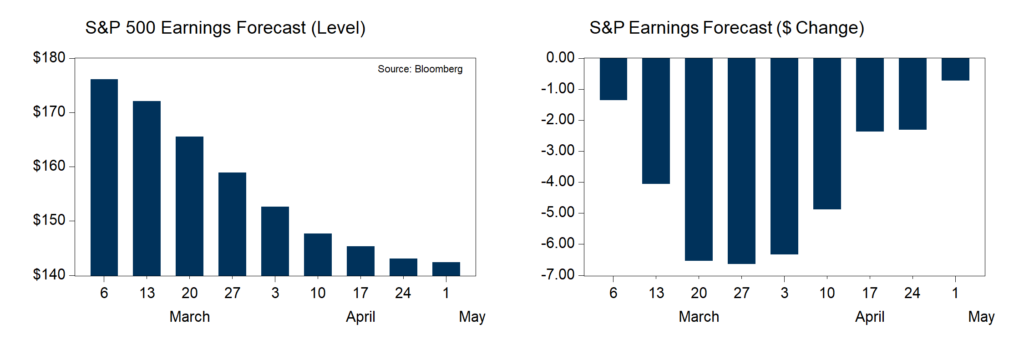

- Credit spreads changed little for the third week in a row (chart F, below), and analysts trimmed less than $1 from S&P 500 earnings forecasts (chart G, below).

Viewed from the perspective of weekly change, it seems that we may be starting to see hints of progress.

Chart A

Chart B

Chart C

Chart D

Chart E

Chart F

Chart G

A Deep Hole

Once the slide ends, we will still find ourselves in a rather deep hole with many unanswered questions about the future. It is important not to lose sight of the size of the human and financial toll. Last week, the Covid-19 death toll rose above 60,000 (chart, above), job losses exceeded 30 million (chart, above), and the economy is expected to contract between 15-30% in the second quarter. The depth of the economy’s slide is making it nearly impossible for many companies and analysts to forecast near-term profits, according to a recent report from FactSet. And the path of the disease, timeline for a cure or treatment, and interim mitigation measures are all unknowns that will dictate that pace at which conditions improve.

Earnings Forecasts Slide, Valuations Jump

As a best efforts guess, analysts now expect S&P 500 earnings to decline 30% in the second quarter and 15% for the full year, according to FactSet. At the same time, rebounding stock prices in April against sliding earnings forecasts leaves the S&P 500 trading at 19x forward earnings. By contrast, the 10-year average multiple is closer to 15x. The rise in multiple implies that investors are looking past the 2020 earnings hole under the assumption a staged reopening of the economy should proceed, recurrences of outbreaks are likely to be small and contained, and severe mitigation measures should not need to be reinstituted. The markets expect more improvement ahead, and will now look for more than hints of progress but strong corroborating evidence things are getting better.

Monthly WCA Barometer Update

We continue to update our readers on our monthly tracking of conditions alongside weekly observations. With April in the books, we now forecast a the WCA Fundamental Conditions Barometer (below) will advance over the next few months. CONQUEST tactical asset positioning is aligned with this forecast. Equity exposure is below benchmark in the satellite portion of portfolios (short-term focus). In the core of portfolios (long-term focus), we are overweight domestic versus foreign and emerging over developed. We remain overweight value versus growth. Portfolios are underweight high-yield corporate bonds versus the benchmark and overweight gold. As conditions evolve, we will continue to revise our short and long term tactical positioning.

S&P 500 — The Standard & Poor’s 500 Index is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 High Beta Index measures the performance of 100 constituents in the S&P 500 that are most sensitive to changes in the market. Constituents are weighted relative to their level of market sensitivity, with each stock assigned a weight proportional to its beta.

The S&P 500 Low Volatility Index measures performance of the 100 least volatile stocks in the S&P 500. The index benchmarks low volatility or low variance strategies for the U.S. stock market. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights.

Disclosures:

The Washington Crossing Advisors’ High Quality Index and Low Quality Index are objective, quantitative measures designed to identify quality in the top 1,000 U.S. companies. Ranked by fundamental factors, WCA grades companies from “A” (top quintile) to “F” (bottom quintile). Factors include debt relative to equity, asset profitability, and consistency in performance. Companies with lower debt, higher profitability, and greater consistency earn higher grades. These indices are reconstituted annually and rebalanced daily. For informational purposes only, and WCA Quality Grade indices do not reflect the performance of any WCA investment strategy.

Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely regarded Standard & Poor’s 500 Index, which is generally considered representative of the U.S. large capitalization market. The index has the same constituents as the capitalization-weighted S&P 500, but each company in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.