When Going Gets Tough: Quality or Yield?

Where do you want to be invested when faced with the prospect of a bear market? Some say that high dividend yields provide protection when stocks fall. This implies that since the yield rises as the stock price declines, new buyers will be attracted as the price drops. Such buyers could help establish a “floor” below the stock. While this sounds good in theory, we find scant evidence that it actually works in practice.

This strategy fails when needed most because “high yielders” tend to be fundamentally weak. While some high-yielding stocks may be good bargains, most high yields reflect poor quality or poor growth prospects. We believe that owning the most flexible, durable, and predictable high-quality stocks during a downturn tends to be a better option.

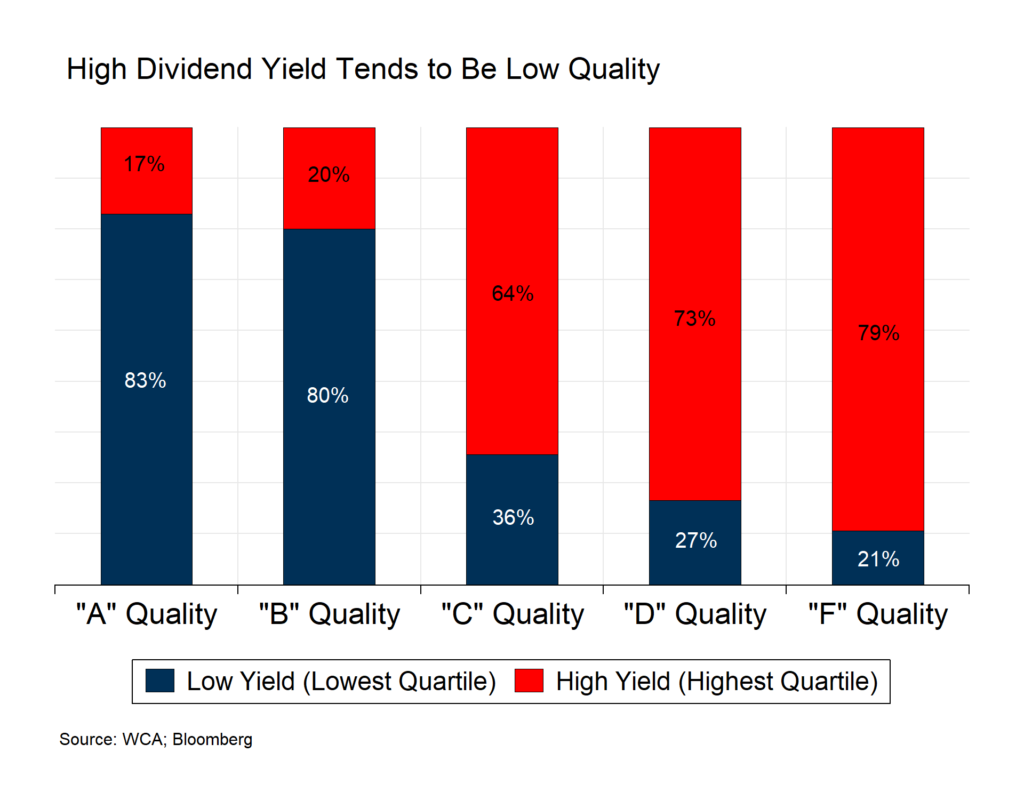

High Yield Tends to be Low Quality

We crunched some data to test the idea that high-yielding stocks tend to be low-quality.

First, we categorized the 1,000 largest U.S. companies into “buckets” based on quality and yield. We assigned grades “A” through “F” for quality based on profitability, consistency, and indebtedness. We tracked the performance of each quality grade bucket. More profitable, more consistent, and lower debt companies earned higher marks, while less profitable, less consistent, higher debt companies earned lower marks.

Next, we ranked the same companies by dividend yield, placing higher yield stocks into a “High Yield” bucket and lower yield stocks into a “Low Yield” bucket. We excluded stocks without dividends and tracked the performance of each category grouped by dividend yield.

Lastly, we compared the composition of the quality buckets by dividend yield category. Chart A below shows that high-quality companies tend to carry lower yields, and low-quality companies have high yields. Within the “A” Quality bucket, 83% is low yield, and 17% is high yield. The “F” Quality bucket is made up overwhelmingly of “High Yield” stocks (79%) and only 21% “Low Yield.” Thus, the more companies a portfolio holds with high yields, the more likely it is that the portfolio also has a lower-quality (aka. “higher risk”) tilt.

As you are about to see, this low-quality tilt can increase risk in a market selloff.

Chart A

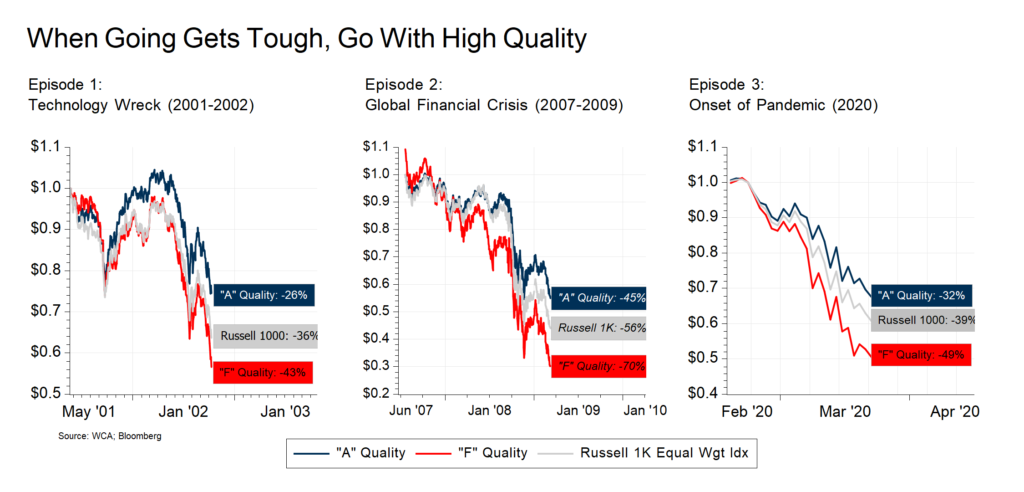

When Going Gets Tough, Go With High Quality

Pivoting away from high yield, which can lead to low quality and risk, is the first step in addressing the “high-yield is safe” error. With a focus now on fundamentals, we see that the nature of a business and how it is financed means far more than yield, especially during tough times.

During the past three market crises, high quality has held up far better than both the market and low quality (Chart B).

Chart B

Let’s walk through each:

1) The Technology Wreck (2000-2002)

This episode brought pain to the NASDAQ and the overall market. Before the slide, low-quality “F” stocks yielded 2.7%, versus 1.7% for high-quality “A” stocks. Yet, the higher-yielding low-quality “F” stocks fell by 43% from May 2001 through October 2002. By contrast, the lower-yielding “A” quality stocks fell by just 26%.

2) The Global Financial Crisis (2007-2009)

The Global Financial Crisis took the market down sharply again. When the market was down about 56% from July 2007 through March 2009, the lower quality higher-yielding “F” Quality stocks were down 70%. Over the same period, the “A” Quality stocks fell an average of 45%, resulting in a 25% outperformance versus “F” Quality. The fact that low-quality stocks’ average yield rose to 6.1% by 2008 was little recompense for the damage done.

3) The COVID-19 Pandemic (2020)

When the pandemic began in 2020, the market was again tested. Stock market averages fell more sharply than almost any other time in history. In days, the market (Russell 1000 Index) was down 39%, while “F” Quality stocks fell an average of 49%. Over the same period, “A” Quality stocks dropped an average of 32%, outperforming the overall market and lower-quality, higher-yielding stocks.

Conclusion

As you can see, while a high dividend yield may occasionally point to value, it usually means low-quality fundamentals and more risk. Thus, we caution against over-emphasizing high dividend yield and focusing instead on quality.

Given the years of run-up from the Global Financial Crisis through today, now may be the right time to emphasize high quality for its better defensive characteristics.

Disclosures:

The Washington Crossing Advisors’ High Quality Index and Low Quality Index are objective, quantitative measures designed to identify quality in the top 1,000 U.S. companies. Ranked by fundamental factors, WCA grades companies from “A” (top quintile) to “F” (bottom quintile). Factors include debt relative to equity, asset profitability, and consistency in performance. Companies with lower debt, higher profitability, and greater consistency earn higher grades. These indices are reconstituted annually and rebalanced daily. For informational purposes only, and WCA Quality Grade indices do not reflect the performance of any WCA investment strategy.

Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely regarded Standard & Poor’s 500 Index, which is generally considered representative of the U.S. large capitalization market. The index has the same constituents as the capitalization-weighted S&P 500, but each company in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.