To The Bone

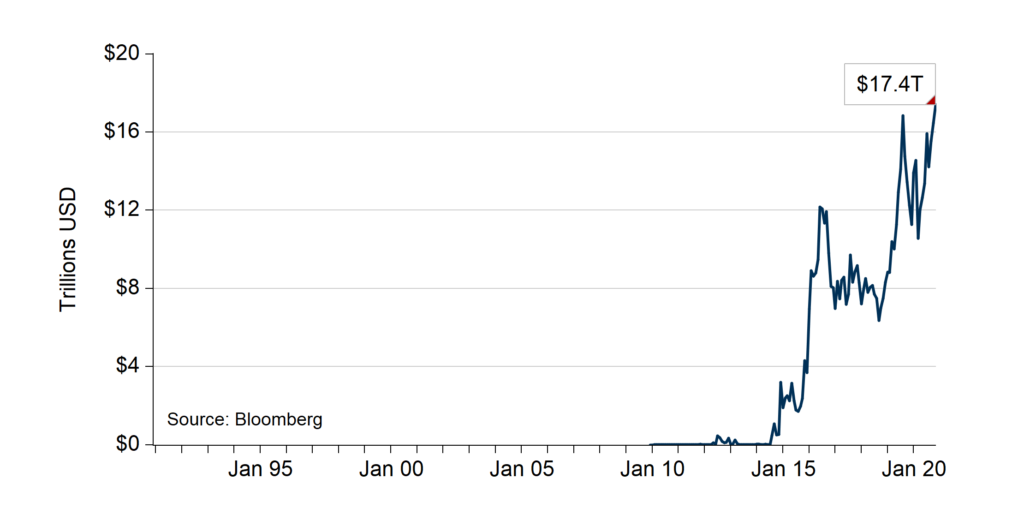

Interest rates on bonds are at very low levels. The decline in the United States rates follows those of other sovereigns like Germany, the United Kingdom, and Japan (Chart A, below). In turn, global rates are following a long-established, declining secular trend. That trend leads to “negative” rates with more than $17 trillion in such debt circulating globally (Chart B, below). The defeating of inflation and worries of deflation may be behind this trend. Still, other factors may also be at work.

Chart A

U.S. Long-Term Treasury Yields vs. Average Foreign Yield (Germany, United Kingdom, Japan)

Chart B

Aggregate Global Negative Yielding Debt

($ Market Value)

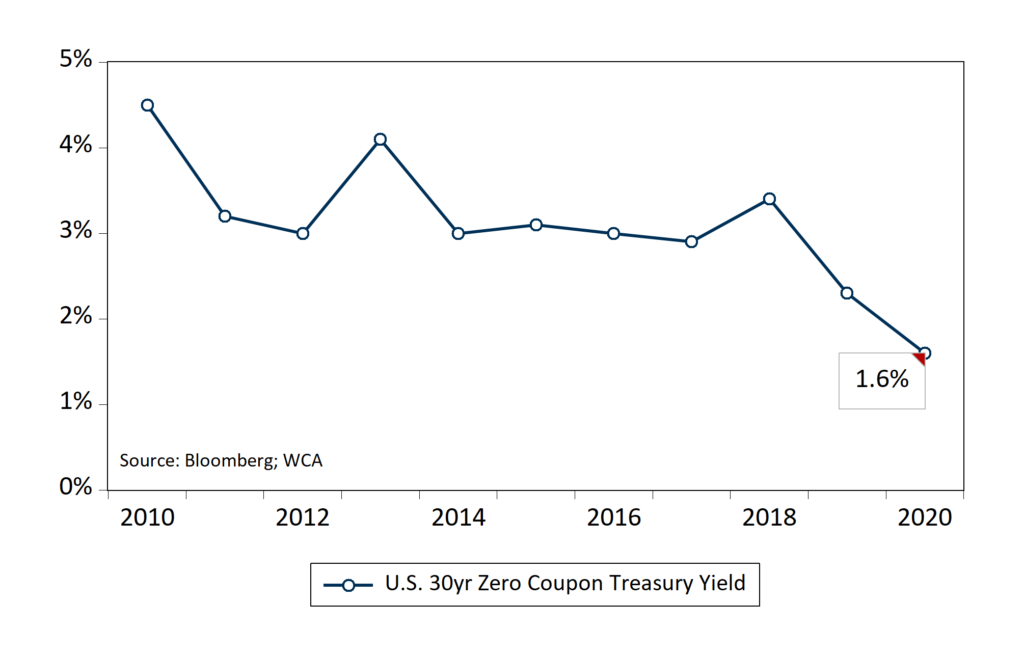

Whatever the reason, the decline in U.S. Treasury rates means bond portfolio values are flush, but lower potential returns may lie ahead. Consider that today’s thirty-year, zero-coupon U.S. Treasury bond is now priced to return just 1.6% annually (Chart C, below). Not only is this below the 1.7% inflation forecast priced into the Treasury Inflation-Protected Securities (TIPS) market, but near past historic lows too.

Could the latest slide in rates be explained by COVID-19 and a temporary falloff in growth? Of course. So it is reasonable to imagine that a return to faster growth after COVID-19 might also lead to higher yields on Treasury bonds. An immediate rise to 3%, for example, would roughly translate into 30% decline for the 30-year zero-coupon Treasury. Such a decline would take back much of the run-up in the bond’s price associated with 2020’s pandemic and slowdown.

Chart C

U.S. 30-Year, Zero-Coupon Treasury Yield

Japan

While “normalization” to higher levels is still our long-run forecast (see Viewpoint 2020), it is plausible that we follow Japan’s lead. In this scenario, global growth slows to a crawl, deflation remains a persistent threat, and rates remain stuck well below historical levels. Today, for example, a 30-year Japanese Government Bond yields a mere 0.6%, a full 1.0% below that of a similar U.S. bond. If we repriced the 30-year Treasury bond using Japanese rates, the U.S. bond would rise in price by roughly 30%.

We are not forecasting the “Japan” scenario as the most likely one. Instead, we expect rates to move higher as global growth picks up in 2021-2022. Still, it is worth considering what an alternative scenario might look like if we are wrong.

1902

To find a similar situation, we need to go all the way back to 1902. According to The Financial Review (February 1903), a 2% coupon U.S. Treasury due in 1930 traded at $109.625 in March 1902 to yield 1.6%. While that rate marked the low-water mark for Treasuries, that environment of low rates remained for several years. In 1906, for example, buyers were still anxious to buy Panama Canal 2% bonds at $104 to yield 1.6%. But by 1920, long-term Treasury rates had risen back to 4-5.5%. Still, prosperity in America advanced rapidly over the 1902-1920 period without a major setback despite higher interest rates.

Roman ZIRP

It is hard to find other examples of rates lower than today — for this one we dig into antiquity. A scan of Sidney Homer and Richard Silla’s A History of Interest Rates reveals one short period in Roman history. Following the Gallic invasion of 387 B.C., Rome was beset with distress, destruction, and debt. A series of government actions were taken to ease the debt burden. Around 342 B.C., interest was banned altogether. Still, the Roman’s “zero interest rate policy” (ZIRP) only held for a short time, and the legal rate returned to 8.3%. So much for Rome’s early experiment with Zero Interest Rate Policies!

Final Thoughts

COVID-19 exposed weaknesses in the global economy in 2020, stripping to the bone returns to be expected from bonds. U.S. interest rates remain above levels available in other parts of the world but near historic lows. While our forecast called for a process of rate normalization this year, COVID-19 pushes that process off to the future. For now, low interest rates are leaving investors with lower expected returns than before. In this low-yield environment, managing credit quality and duration becomes more critical. Tactical asset allocation choices also become more of a focus for investors looking to potentially outperform a passive bond benchmark.

Kevin R. Caron, CFA

Senior Portfolio Manager

973-549-4051

Chad Morganlander

Senior Portfolio Manager

973-549-4052

Matthew Battipaglia

Portfolio Manager

973-549-4047

Steve Lerit, CFA

Senior Risk Manager

973-549-4028

Tom Serzan

Analyst

973-549-4335

Suzanne Ashley

Internal Relationship Manager

973-549-4168

Eric Needham

Director, External Sales and Marketing

312-771-6010

Jeffrey Battipaglia

Client Portfolio Manager

973-549-4031

Disclosures

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.

Disclosures

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.