The Magic Garden of Growth

The gardener must sow seed in fertile ground for a garden to grow. Once planted, young seedlings must be cared for and cultivated. If all goes well, the seed grows into an abundant garden, while also producing the seed and nutrients for next year’s plantings. In this way, the gardener achieves a sustained cycle of growth, and everyone benefits.

The same is true for a business. Like a seed, a firm must sow investments in assets that yield a profit if it hopes to grow. Additionally, investments will be subject to risk and unknowns, some will produce profit, and some will not. In other words, the entrepreneur must take a risk if the business is to grow. But if investment in productive assets leads to profit, the stage for growth is set.

How Growth Works (In Theory)

We would like to propose that a direct but imprecise relationship between investment and profitability actually does exist. To test this simple idea, we first need to describe what we mean by “sustainable growth.”

Like our garden example, our definition of “sustainable growth” will see investment in assets like the “seed” in the garden and the asset’s profitability as synonymous with “fertility.” The right mixture of investment and profitability should, according to our theory, create organic, sustainable growth. For example, if ABC company invests 50% of available incoming funds in new assets (returning the other 50% to shareholders) and those assets that produce a 10% profit, then sustainable growth would be 5% (50% x 10% = 5%). The intuition is simple here — higher investment and profitability should cause higher growth, all else being equal.

How Growth Works (In the Real World)

Of course, as with gardening, not all investment “seeds” grow at all, as some die off and other investments grow unexpectedly tall. Yet, there is a clear and undeniable line of causation directly from investment in profitable assets to resulting growth. At the risk of stating the obvious, profitable investments really do tend to drive growth.

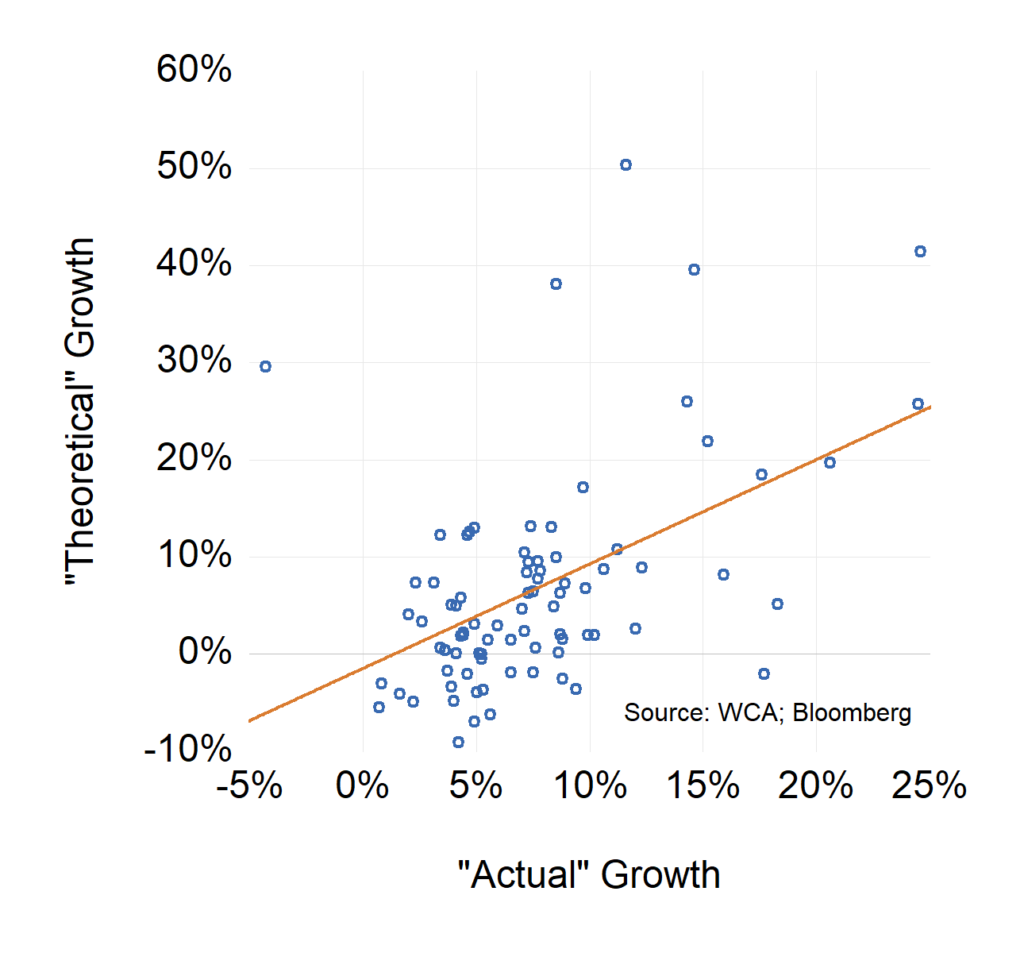

To test if there is any evidence in the real world to support the “sustainable growth” theory, we looked at data on the hundred largest non-financial U.S. companies by market value. We plotted the theoretical “sustainable growth” based on our growth formula and the last five years of data on the bottom axis. We then plotted the corresponding actual observed sales growth rate on the vertical axis for each company (chart below). A clear and positive, albeit imperfect, relationship can be seen between the theoretical and actual growth patterns.

Comparing “Theoretical” vs. “Real World” Growth

100 Largest U.S. Non-Financial Companies, Last 5 Yrs

We found that these giant firms averaged $1.3 trillion of available funds each year over the past five years. Available funds include funds from operations, drawdown of cash on hand, net debt issuance, and other sources. About $750 billion was invested back into new assets from these funds with the remaining $550 billion paid to shareholders through dividends and net share buybacks. Investments included acquisitions, fixed and intangible asset purchases, research and development, and other types of investment. In other words, about 60% of available funds were reinvested for future growth and 40% was paid to owners (shareholders).

What about profitability? The firms’ boasted average assets of $9 trillion and generated operating cash of $1.2 trillion, making the assets’ operating profitability about 13% ($1.2 trillion operating profit / $9 trillion assets = 13% operating profitability). So, by our measure, sustainable top-line growth should be close to 7% (60% reinvestment rate times 13% operating profitability ≈ 7.5% “sustainable growth”).

What actually happened? Over the five-year period, the firms delivered average top-line growth near 7%, just shy of our 7.5% theoretical growth estimate.

Conclusion

As you can see, while growth may often seem like it arises from a “magic” garden, it actually originates from easy-to-understand fundamental causes. And while there is no way to perfectly predict growth, most growth can be traced to investment in productive and profitable assets.

At Washington Crossing, we believe we are value investors who care not only about the price paid but also what we are buying. The practice of evaluating price to quality and growth is essential in our view.

Disclosures:

The Washington Crossing Advisors’ High Quality Index and Low Quality Index are objective, quantitative measures designed to identify quality in the top 1,000 U.S. companies. Ranked by fundamental factors, WCA grades companies from “A” (top quintile) to “F” (bottom quintile). Factors include debt relative to equity, asset profitability, and consistency in performance. Companies with lower debt, higher profitability, and greater consistency earn higher grades. These indices are reconstituted annually and rebalanced daily. For informational purposes only, and WCA Quality Grade indices do not reflect the performance of any WCA investment strategy.

Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely regarded Standard & Poor’s 500 Index, which is generally considered representative of the U.S. large capitalization market. The index has the same constituents as the capitalization-weighted S&P 500, but each company in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.