The Changes at Hand

The stock market is near $50 trillion in value, about $15 trillion greater than before COVID-19. Stock values rose far faster than bonds, market earnings forecasts are hitting new highs, and companies are finding it easy to borrow. Yet there are signs that this happy situation could be poised to change. This week, we look at some recent evidence to support this claim.

Inflation Boom

From the early days of the pandemic, Congress and the Federal Reserve (Fed) spared little to stimulate growth despite shutdowns. Federal borrowing expanded by 36%, or $8 trillion, to finance direct payments to private businesses and households. The Fed helped finance this spending by buying government and other bonds, increasing the money supply by 47% ($7 trillion).

Now, that expansion of money is contributing to a rise in inflation, in our view, and creating pressure to curtail further growth. Consumer prices are up 7% and producer prices up 12% from a year ago, both registering 40-year highs. Global energy and industrial metals prices are also up a staggering 50% and 60%, respectively. While supply chain issues exacerbate the issue, the leading cause is likely rooted in excess borrowing and money creation. History has proven a linkage between these factors time and again across multiple decades and economies.

As policymakers seek to put the inflation “genie” back in the bottle, the risks of a misstep rise. Will a bust follow this boom, or will policymakers achieve a “soft-landing”? Only time will tell how this plays out.

A Harder Climb

The transition to the next phase appears to be well underway. While earnings, credit spreads, and the Treasury yield curve point to growth, some conflicting signs emerge. For example, the ratio of advancing versus declining stocks on the New York Stock Exchange has rolled over. The ratio of high-risk stocks (high beta) to low-risk stocks (low beta) has been moving sideways after a sharp rise in 2021. Many meme stocks and “stay at home” themed stocks have retreated from highs. Lastly, the bond market is well along in repricing the path for interest rates, with forwards markets expecting higher short-term interest rates.

The transition also will shape the earnings outlook, the most significant factor driving stock returns. At present, S&P 500 earnings are up more than 25% in each of the past four quarters, according to FactSet. For the full year 2021, earnings are up 45% compared with very easy comparisons in 2020.

Looking Below the Surface

Despite good earnings, the market is looking forward. With more than half the companies have reported Q4 results already, the stock market performance has been mixed. While energy and financials are doing well given rising energy prices and interest rates, many other stocks are struggling. The table below shows various categories’ average year-to-date stock performance through February 6, 2022.

As you can see, many stocks and sectors are faring worse than the market averages. Those stocks performing best are more defensive, dividend-paying, and larger in size. Financials and energy companies are benefitting from anticipated higher interest rates and rising commodity prices. Since higher interest and energy costs are a cost to most businesses and households, further increases in either or both things threaten to sap real income and savings.

A positive from all of this is that multiples have begun to adjust down, reducing valuation drag. The forward earnings multiple for the S&P 500 is now 19.7x (18% above the 10-year average) versus 21.3x on December 31 (28% above the 10-year average). A positive outcome could be that this recent shakeout sets the stage for a more durable pull into 2022-2023.

Year-to-Date Average U.S. Stock Returns

Based on Largest 3,000 U.S. Stocks by Market Capitalization

| Category | Return % (YTD) |

|---|---|

| Small (Bottom Decile) | -18.1% |

| Non-Dividend Payer | -14.0% |

| All Stocks | -9.5% |

| Dividend Payer | -4.0% |

| Large (Top Decile) | -2.9% |

| * Based on Total Market Value (Equity + Debt) |

| Sector | Return % (YTD) |

|---|---|

| Health Care | -17.8% |

| Technology | -12.6% |

| Consumer Discretionary | -11.3% |

| Industrials | -10.6% |

| Real Estate | -8.2% |

| Communication | -7.8% |

| Materials | -7.6% |

| Staples | -7.3% |

| Financials | -1.6% |

| Energy | +14.2% |

| S&P 500 (Market Cap Weighted) | -5.5% |

Source: Bloomberg; WCA

Earnings Pressure Ahead

We expect earnings growth to slow. The easy comparisons are behind us now, producer prices (+12%) are outstripping consumer prices (+7%), and hourly earnings are up 5.7%. Add higher energy and materials costs, continuing shortages, and higher forecast interest costs, and it becomes hard to see how rapid earnings growth continues.

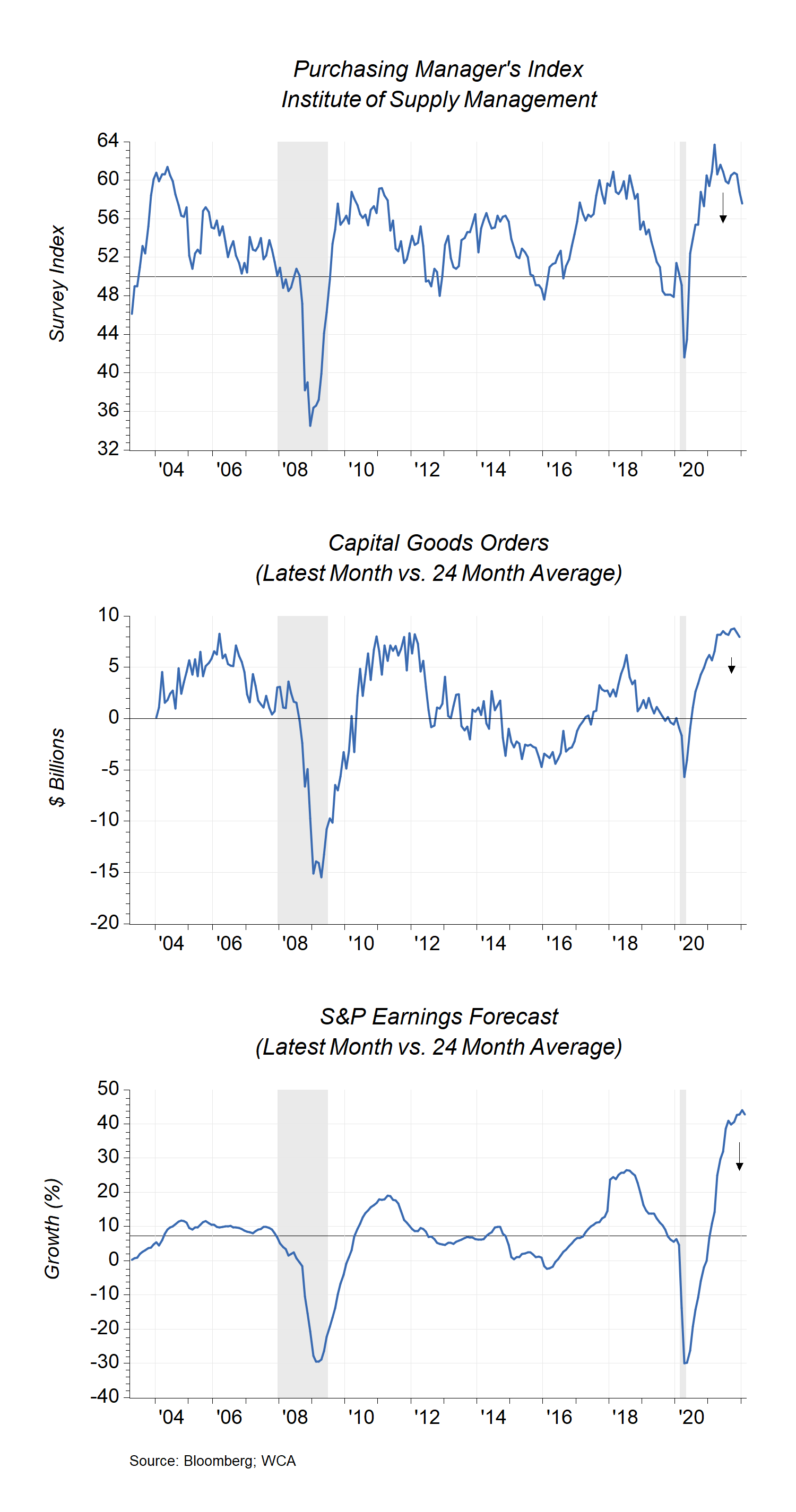

It is also apparent that critical indicators of the cycle are poised to move lower. The charts below show the Institute of Supply Management’s Purchasing Manager’s Index (PMI), Core Capital Goods Orders (a proxy for business investment), and S&P 500 profit forecasts versus a two-year moving average. Each indicator is cyclical, and each is near peak levels. The PMI is rolling over, capital goods orders appear poised to follow, and profits tend to follow both.

Given these bottom-up and top-down observations, it is likely that the period of surging profits is now behind us. The easy money has been made, and pressure on the bottom line is expected to increase here.

Charts: Linking Economy to Profit Cycle

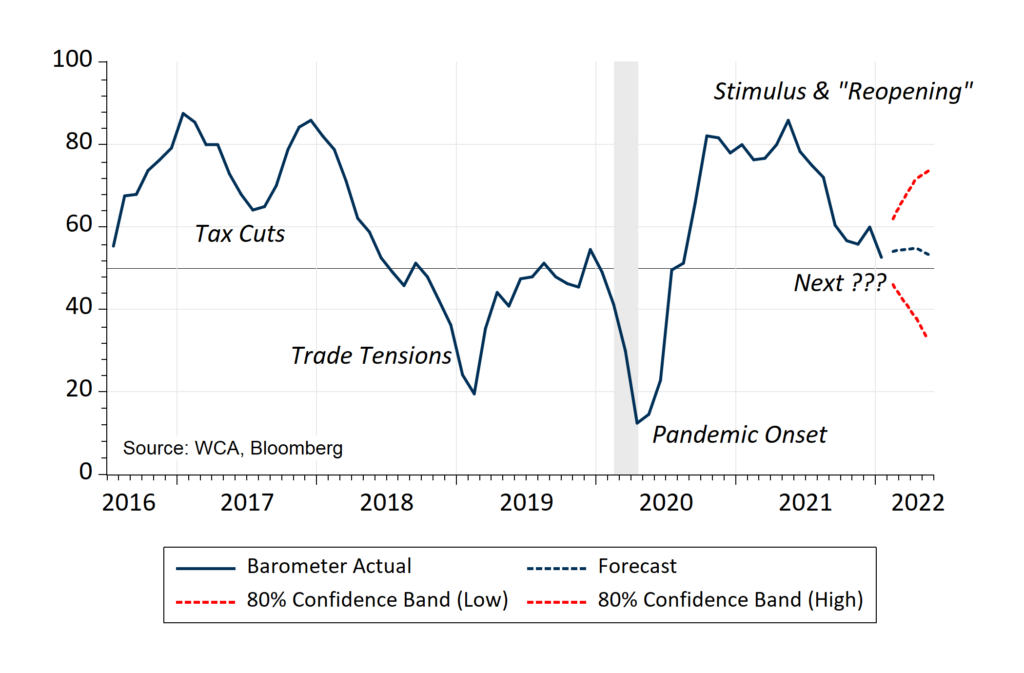

WCA Barometer Update

Lastly, we want to update you on our WCA Barometer (Chart, below). This indicator summarizes many indicators we follow to assess market and economic trends. We now see a more mixed bag than several months ago. The near-term forecast for conditions is about average, having dropped from a more clearly expansionary bias last year. The stimulus and vaccine-induced up-swelling of activity post-shutdown is clearly fading. We are left with a less clear outlook and, as such, have returned equity exposure to “neutral” in tactically allocated portfolios.

WCA Barometer

Conclusion

This week’s (rather long-winded) commentary leads us to conclude that we are likely at the close of an era. The factors that drove markets from the bottom in 2020 through 2021 are shifting. Accordingly, a more careful approach seems warranted.

We recommend the following:

- Focusing on higher-quality companies with growing dividends

- Laddering bond exposure in light of a potentially higher and less certain rate environment ahead

- Approaching investments with a more flexible and tactical approach

WCA Fundamental Conditions Barometer:

We regularly assess changes in fundamental conditions to help guide near-term asset allocation decisions. The analysis incorporates approximately 30 forward-looking indicators in categories ranging from Credit and Capital Markets to U.S. Economic Conditions and Foreign Conditions. From each category of data, we create three diffusion-style sub-indices that measure the trends in the underlying data. Sustained improvement that is spread across a wide variety of observations will produce index readings above 50 (potentially favoring stocks), while readings below 50 would indicate potential deterioration (potentially favoring bonds). The WCA Fundamental Conditions Index combines the three underlying categories into a single summary measure. This measure can be thought of as a “barometer” for changes in fundamental conditions.

Disclosures:

The Washington Crossing Advisors’ High Quality Index and Low Quality Index are objective, quantitative measures designed to identify quality in the top 1,000 U.S. companies. Ranked by fundamental factors, WCA grades companies from “A” (top quintile) to “F” (bottom quintile). Factors include debt relative to equity, asset profitability, and consistency in performance. Companies with lower debt, higher profitability, and greater consistency earn higher grades. These indices are reconstituted annually and rebalanced daily. For informational purposes only, and WCA Quality Grade indices do not reflect the performance of any WCA investment strategy.

Standard & Poor’s 500 Index (S&P 500) is a capitalization-weighted index that is generally considered representative of the U.S. large capitalization market.

The S&P 500 Equal Weight Index is the equal-weight version of the widely regarded Standard & Poor’s 500 Index, which is generally considered representative of the U.S. large capitalization market. The index has the same constituents as the capitalization-weighted S&P 500, but each company in the index is allocated a fixed weight of 0.20% at each quarterly rebalancing.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecast in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small-company stocks are typically more volatile and carry additional risks since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. Bond laddering does not assure a profit or protect against loss in a declining market. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Changes in market conditions or a company’s financial condition may impact a company’s ability to continue to pay dividends, and companies may also choose to discontinue dividend payments.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance, and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors, LLC is a wholly-owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF). Registration with the SEC implies no level of sophistication in investment management.