Monday Morning Minute 043018

WASHINGTON CROSSING ADVISORS

THE WEEK AHEAD

Big week for data and Fed policy this week.

MACROECONOMIC INSIGHT

We’ve seen some slowing in growth lately, but last week’s advance U.S. Gross Domestic Product report was encouraging. Readers of the Monday Morning Minute know that incoming data raised some red flags in the first quarter. Our Fundamental Conditions Barometer peaked with the passage of the tax act in December, declined through the remainder of the winter, and stabilized in April.

According to last week’s report from the Bureau of Economic Analysis, the U.S. economy grew by an estimated 2.3% in the first quarter. This result is lower than the 2.75% rate most economists expected back in February (Blue Chip survey), but was not bad given some weaker readings on consumption and manufacturing recently. In addition, there is reason to expect things to firm up from here as tax cuts flow through to the private sector. We will be closely watching this week’s consumer, manufacturing, and employment data to see if April’s readings point to a “spring bounce” or not.

Meanwhile, a closer look at last week’s advance GDP report reveals important takeaways on the state of the economy.

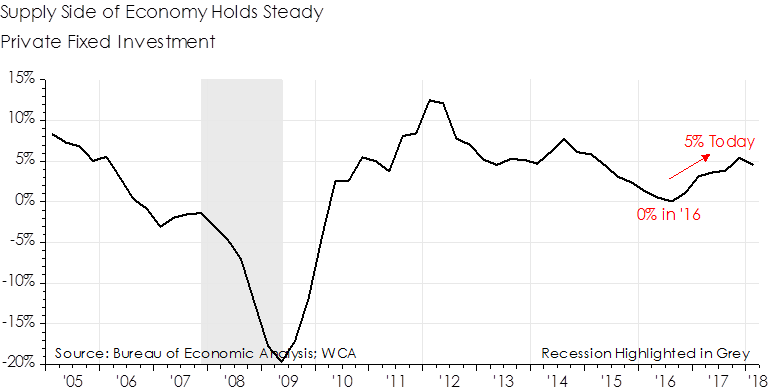

The Supply Side

Optimism that came with improving global growth in 2016-2017, coupled with tax cuts, is showing up as more investment. Greater growth, optimism, and investment can all be helpful in extending the cycle and boosting profits. On a longer-term basis, investment is a major contribution to lifting potential growth.

According to data on capital formation within the GDP report, we see that private capital formation, a proxy for investment, is estimated to be growing near 4.6% (chart, below). This is a significant improvement from 2016, when investment essentially ground to a halt. Sustaining this trend is important for the market as a whole because it encapsulates critical information about business expectations as a whole.

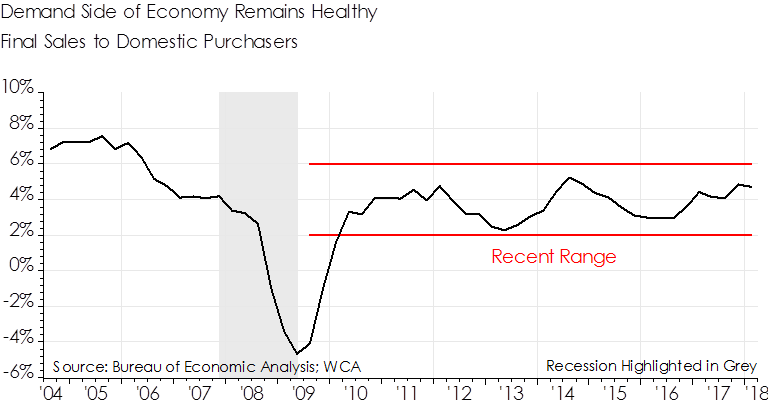

The Demand Side

Because risk-taking entrepreneurs and businesses of all stripes make plans based on expected demand for their products, it is important to take a look at trends in demand. Buried deep in the report is a helpful measure of this demand. It is called “Final Sales of Domestic Product.” This is a cleaner measure of the demand side of the economy as it excludes inventories and looks at what people are actually spending. Whenever this measure is running below overall production (GDP), businesses might have reason to worry (chart, below).

With signs of steady growth in the economy, coupled with above 50 readings on our WCA Fundamental Conditions Barometer, we expect further growth ahead. And as the Federal Reserve gets set to meet on rates this week, we expect the central bank to affirm their plans to continue rate increases against a background of firming inflation and full employment.

ECONOMIC DATA THIS WEEK

| Date | Report | Period | Survey | Prior |

| Mon, Apr 30: | Personal Income | Mar | 0.4% | 0.4% |

| Personal Spending | Mar | 0.4% | 0.2% | |

| Chicago PMI | Apr | 58.0 | 57.4 | |

| Pending Home Sales M/M | Mar | 0.5% | 3.1% | |

| Pending Home Sales Y/Y | Mar | — | -4.4% | |

| Tues, May 1: | FOMC Meeting Begins | |||

| PMI Manufacturing Index | Apr | — | 56.5 | |

| Construction Spending M/M | Mar | 0.3% | 0.1% | |

| ISM Manufacturing Index | Apr | 58.5 | 59.3 | |

| Wed, May 2: | FOMC Meeting Announcement | |||

| ADP Employment Report | Apr | 204k | 241k | |

| Thurs, May 3: | Weekly Jobless Claims | Apr 28 | — | 209k |

| International Trade Balance | Mar | -$56.0b | -$57.6b | |

| Nonfarm Productivity | 1Q2018 | 1.0% | 0.0% | |

| Unit Labor Costs | 1Q2018 | 3.1% | 2.5% | |

| Factory Orders | Mar | 0.9% | 1.2% | |

| ISM Non-Manufacturing Index | Apr | 58.3 | 58.8 | |

| Fri, May 4: | Change in Nonfarm Payrolls | Apr | 190k | 103k |

| Unemployment Rate | Apr | 4.0% | 4.1% | |

| Underemployment Rate | Apr | — | 8.0% | |

| Average Hourly Earnings M/M | Apr | 0.2% | 0.3% | |

| Average Hourly Earnings Y/Y | Apr | — | 2.7% | |

| Average Weekly Hours | Apr | 34.5 | 34.5 | |

| Labor Force Participation Rate | Apr | — | 62.9% | |

| Source: Bloomberg | ||||

ASSET ALLOCATION PORTFOLIO POSTURE

Based on shorter-term expectations, the “tactical satellite” allocation within portfolios is:

Overweight Stocks vs. Bonds

Kevin Caron, CFA, Senior Portfolio Manager

Chad Morganlander, Senior Portfolio Manager

Matthew Battipaglia, Portfolio Manager

Suzanne Ashley, Analyst

(973) 549-4168

www.washingtoncrossingadvisors.com

_______________________________________________________________________________________________________________________________________

Disclosures

WCA Fundamental Conditions Barometer Description: We regularly assess changes in fundamental conditions to help guide near-term asset allocation decisions. The analysis incorporates approximately 30 forward-looking indicators in categories ranging from Credit and Capital Markets to U.S. Economic Conditions and Foreign Conditions. From each category of data, we create three diffusion-style sub-indices that measure the trends in the underlying data. Sustained improvement that is spread across a wide variety of observations will produce index readings above 50 (potentially favoring stocks); while readings below 50 would indicate potential deterioration (potentially favoring bonds). The WCA Fundamental Conditions Index combines the three underlying categories into a single summary measure. This measure can be thought of as a “barometer” for changes in fundamental conditions.

The information contained herein has been prepared from sources believed to be reliable but is not guaranteed by us and is not a complete summary or statement of all available data, nor is it considered an offer to buy or sell any securities referred to herein. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. There is no guarantee that the figures or opinions forecasted in this report will be realized or achieved. Employees of Stifel, Nicolaus & Company, Incorporated or its affiliates may, at times, release written or oral commentary, technical analysis, or trading strategies that differ from the opinions expressed within. Past performance is no guarantee of future results. Indices are unmanaged, and you cannot invest directly in an index.

Asset allocation and diversification do not ensure a profit and may not protect against loss. There are special considerations associated with international investing, including the risk of currency fluctuations and political and economic events. Investing in emerging markets may involve greater risk and volatility than investing in more developed countries. Due to their narrow focus, sector-based investments typically exhibit greater volatility. Small company stocks are typically more volatile and carry additional risks, since smaller companies generally are not as well established as larger companies. Property values can fall due to environmental, economic, or other reasons, and changes in interest rates can negatively impact the performance of real estate companies. When investing in bonds, it is important to note that as interest rates rise, bond prices will fall. High-yield bonds have greater credit risk than higher-quality bonds. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.

This commentary often expresses opinions about the direction of market, investment sector and other trends. The opinions should not be considered predictions of future results. The information contained in this report is based on sources believed to be reliable, but is not guaranteed and not necessarily complete.

The securities discussed in this material were selected due to recent changes in the strategies. This selection criterion is not based on any measurement of performance of the underlying security.

Washington Crossing Advisors LLC is a wholly owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp (NYSE: SF).