Pfizer Inc. (NYSE: PFE) Q1 ’23

9 December 2022 I New York, NY

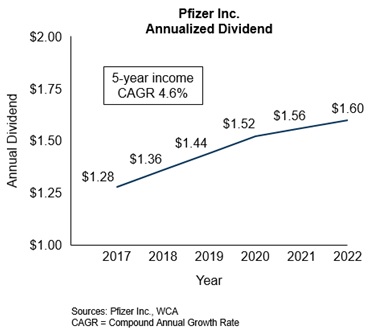

The board of directors of Pfizer Inc. (NYSE: PFE) has declared a regular quarterly dividend of $0.41 per common share, an increase of approximately 3% from the previous quarterly dividend of $0.40.

For calendar year 2023, this marks the fourth dividend change for the Washington Crossing Advisors Rising Dividend portfolio. All four changes were increases. The average dividend increase is 5.12% compared with December 31, 2022 indicated levels.

For a complete list of all portfolio holdings that have, in the past 12 months, increased, decreased, or had no change in dividend, please contact your financial advisor.

From the press release: “Pfizer Inc. (NYSE: PFE) today announced that its board of directors declared an increase in the quarterly cash dividend on the company’s common stock to $0.41 for the first-quarter 2023 dividend, payable March 3, 2023, to holders of the Common Stock of record at the close of business on January 27, 2023. The first-quarter 2023 cash dividend will be the 337th consecutive quarterly dividend paid by Pfizer.

“Our ability to increase our dividend is a testament to our solid financial performance during 2022,” said Dr. Albert Bourla, Pfizer Chairman and Chief Executive Officer. “This increase reinforces Pfizer’s commitment of returning value to our shareholders.”” 1

About the company: “At Pfizer, we apply science and our global resources to bring therapies to people that extend and significantly improve their lives. We strive to set the standard for quality, safety and value in the discovery, development and manufacture of health care products, including innovative medicines and vaccines. Every day, Pfizer colleagues work across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases of our time. Consistent with our responsibility as one of the world’s premier innovative biopharmaceutical companies, we collaborate with health care providers, governments and local communities to support and expand access to reliable, affordable health care around the world. For more than 170 years, we have worked to make a difference for all who rely on us. We routinely post information that may be important to investors on our website, www.pfizer.com.” 1

IMPORTANT DISCLOSURES: The securities discussed herein do not represent all of the securities held by the WCA Rising Dividend Portfolio as of the date presented and are subject to change at any time, without notice. A complete list of holdings as of the date noted above will be provided upon request. The above is presented to illustrate the application of the strategy only and not intended as personalized recommendations of any particular security. The securities identified and described above do not represent all of the securities purchased, sold, or recommended for client accounts. You should not assume that an investment in any of the securities identified was or will be profitable. Changes in market conditions or a company’s financial condition may impact the company’s ability to continue to pay dividends. Companies may also choose to discontinue dividend payments. All investments involve risk, including loss of principal, and there is no guarantee that investment objectives will be met. It is important to review your investment objectives, risk tolerance and liquidity needs before choosing an investment style or manager. Equity investments are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Fixed Income investments are subject to market, market liquidity, issuer, investment style, interest rate, credit quality, and call risks, among other factors to varying degrees.